✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

Following the April 2025 legislative reforms, UK finance and HR leaders must adapt to the structural payroll tax changes in order to guarantee compliance and effectively plan for rising employment costs.

The 2024 Autumn Budget introduced a significant structural shift in how businesses contribute to the state social security system. For growing companies in the UK, understanding the mechanics of this National Insurance increase is the first step toward effective financial planning.

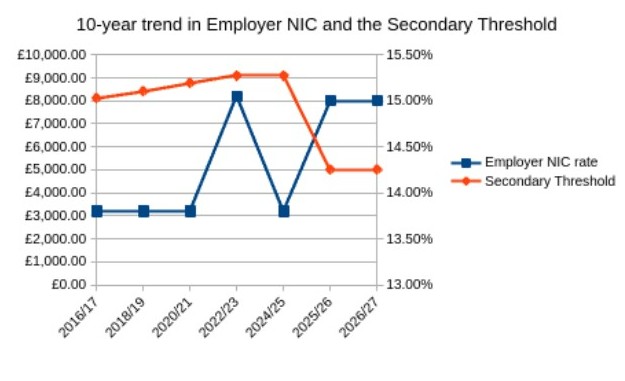

The headline change that continues to impact budgets in 2026 is the increase in the Class 1 Secondary (Employer) NIC rate. Employers are, in fact, now required to contribute 15 percent of the earnings of their employees above the relevant threshold, up from 13.8% in 2024/25.

This 1.2 percentage point hike might seem marginal on paper, but when applied to a growing workforce, the cumulative effect on your annual wage bill is substantial.

This increase does not apply to employee contributions (i.e. Class 1 Primary), which remain protected in order to ensure workers’ take-home pay is not directly hit by the reform.

However, for businesses, every new hire and every salary increase now carries a heavier tax burden. Finance teams therefore need to adjust their models to account for this higher rate, so that their companies have sufficient liquidity to meet their monthly PAYE obligations to HMRC.

Perhaps more impactful than the rate hike itself is the sharp reduction in the Secondary Threshold. Historically, this limit sat much closer to the Primary Threshold for employees. However, since April 2025, employers have been liable for NICs on a much larger portion of an employee’s income.

With the threshold lowered to £5,000 per annum (approximately £96 per week), liabilities are triggered much earlier in the payroll cycle. This change disproportionately affects businesses with a large number of part-time staff or lower-paid workers, as earnings that were previously exempt from employer NICs now fall within the taxable bracket.

| Pay frequency | Previous Secondary Threshold (pre-April 2025) | Current Secondary Threshold (2025/26 & 2026) |

|---|---|---|

| Weekly | £175 | £96 |

| Monthly | £758 | £417 |

| Annual | £9,100 | £5,000 |

For example, a part-time employee earning £8,000 a year would previously have attracted zero employer NICs. But, under the current rules, the employer will pay 15% on the £3,000 difference between the £5,000 threshold and their gross pay. This effectively widens the tax base, having a more significant impact on earnings.

UK statutory employment rights guide

The combined effect of a higher rate and a lower threshold is a double whammy for UK employers. It is therefore really important to model the impact of these changes and understand the scale of the financial commitment required for the 2026 tax year.

| Category | Previous rules (pre-April 2025) | Current rules (2025/26 & 2026) |

|---|---|---|

| Employer NIC Rate | 13.8% | 15% |

| Secondary Threshold (annual) | £9,100 | £5,000 |

| Employment Allowance | £5,000 | £10,500 |

| Employment Allowance Cap | £100,000 | Cap removed |

The following graph plot more immediately illustrates the 2025/26 double whammy effect:

Furthermore, based on current government announcements and the November 2025 OBR forecast, the rate and threshold freeze is set to continue through the 2027/28 tax year, up until 2031.

Furthermore, based on current government announcements and the November 2025 OBR forecast, the rate and threshold freeze is set to continue through the 2027/28 tax year, up until 2031.

In forecasting your headcount costs for 2026, you have to look beyond the gross salary, since the total cost of an employee has risen. Finance managers will therefore need to continually reassess their budgets, in order to ensure that the business does not overextend itself.

Consider the impact across your entire workforce. The portion of earnings subject to the employer charge has risen by £4,100 (the difference between the old £9,100 threshold and the new one set at £5,000). When you apply the 15% rate to this additional band of taxable income, plus the increase on the rest of the salary, the additional liability per employee can range from several hundred to over a thousand pounds annually.

| Gross annual salary | Old Employer NIC cost (approx.) | New Employer NIC cost (approx.) | Total cost to business (salary + new NICs) |

|---|---|---|---|

| £20,000 | £1,504 | £2,250 | £22,250 |

| £30,000 | £2,884 | £3,750 | £33,750 |

| £50,000 | £5,644 | £6,750 | £56,750 |

Note: The ‘total cost’ above includes gross salary and Employer NICs only. It excludes mandatory pension contributions (minimum 3%) and other overheads, which increase the figure further.

It is also important to consider how these changes will interact with other statutory costs, as per the Working Time Regulations. In particular, payments for Statutory Sick Pay (SSP), Maternity Leave and Shared Parental Leave rely on accurate average weekly earnings calculations, which must remain precise in the face of the shifting tax landscape. Ensuring your payroll solution can handle all of these factors automatically is critical in order to avoid errors and HMRC penalties.

There is a small silver lining for many small and medium-sized enterprises (SMEs). To mitigate the impact of the National Insurance increase, the government has significantly extended the scope of the Employment Allowance.

This relief allows eligible employers to reduce their annual National Insurance liability by up to £10,500.

Crucially, the eligibility rule that previously barred companies with a NIC bill of over £100,000 from claiming has been scrapped. This means that larger growing businesses that were previously excluded can now access this relief.

For a micro-business with just a few employees, this increased allowance might completely offset the rise in NICs, effectively shielding them from the tax hike.

However, for a scaling company with 50 or more staff, the relief, while welcome, will likely only cover a fraction of the increased overheads. Managers should verify their eligibility and ensure their claim is submitted via their HMRC RTI submission at the start of the tax year, in order to improve cash flow immediately.

Adapting to these financial realities requires more than just updating a spreadsheet. It demands a strategic approach to managing your people and your payroll processes.

The complexity of the UK tax system means that manual calculations are increasingly risky. With different thresholds for various category letters, including those for under 21s, apprentices, veterans, and employees working in designated Investment Zones and Freeports, the margin for error is slim.

Directors have their own specific rules for National Insurance, which is often calculated on an annual or cumulative basis, rather than weekly or monthly. This ensures that their contributions are correct regardless of irregular payment patterns. Failing to apply the correct logic here can lead to significant underpayments or overpayments, both of which may require costly corrections later on.

Furthermore, benefits in kind remain a key area of focus. The Class 1A NIC rate on benefits such as company cars and private medical insurance is also pegged to the employer rate.

This means providing these perks has become more expensive. Reviewing your benefits package to ensure it remains cost-effective is a particularly wise move at this time.

In this challenging environment, reliance on outdated legacy systems or manual administrative work is a severe liability. The best way to secure your business against compliance risks is to use modern, integrated HR and payroll software that updates automatically in line with legislative reforms.

A dedicated payroll solution does more than just calculate tax. It provides real-time visibility into your labour costs, allowing you to run scenarios and plan for future hires with confidence. For example, if you plan to expand your sales team in Q3 2026, your system should be able to project the exact employer NIC cost based on the current 15% rate and £5,000 threshold.

Moreover, efficiency is paramount. Modern platforms can streamline the distribution of electronic payslips, reducing the administrative burden, and ensuring employees have transparent and immediate access to their data. When you automate all of these administrative tasks, your HR and finance teams can then focus on higher-value work, such as retention strategies, talent acquisition and strategically improving finance processes and cash flow forecasting.

The increase to the employer rate and the reduction of the Secondary Threshold were implemented on 6th April 2025. These rules apply for the full duration of the 2025/26 tax year and will continue through April 2026 to 2027 and beyond. It is vital to note that this was a structural change following the 2025 Autumn Budget, meaning businesses must plan their long-term finances accordingly, rather than treating it as a temporary measure.

Most businesses can claim the allowance, especially now that the £100,000 eligibility cap has been removed. However, certain restrictions still apply, such as for companies where a director is the sole employee. The allowance effectively reduces the employer share of the NIC bill, helping to support cash flow and offset PAYE liabilities. Checking your Employment Allowance eligibility is a crucial first step.

Directors pay National Insurance on an annual earnings basis. The new higher rate of 15% and the lower threshold of £5,000 apply to their annual income, meaning their companies will likely pay more Class 1 Secondary NICs than in previous years. Directors need to carefully review their salary vs dividend mix in light of these higher corporate costs, and the specific Class 1 rules that apply to them.

Generally, relief for employees under 21, apprentices under 25, and veterans applies up to the Upper Secondary Threshold. Earnings up to this limit (often aligned with the Upper Earnings Limit) may be zero-rated for employer contributions. This relief is particularly valuable for businesses with a younger workforce, or those employing staff on the standard National Living Wage, as long as you verify the correct rates are applied each week or month.

Yes, HMRC-compliant automatic data processing for payroll will automatically apply the new £5,000 secondary threshold and 15% rate to your calculations. This automation is essential to handle multiple thresholds correctly, accurately forecast your total PAYE liabilities, and ensure you do not underpay tax.

Currently, the main rate for Employee Class 1 Primary NICs remains at 8%, with a 2% rate on earnings above the Upper Earnings Limit (UEL). The NIC increase is focused solely on employer contributions. However, accurate calculation of average weekly earnings is still required for other statutory payments, such as sick pay and maternity pay, in order to ensure employees receive their full state entitlements. Also ensuring you are managing your year-end payroll processes effectively under evolving regulations is vital for long-term compliance.

Learn how directors’ National Insurance works in the UK in 2026, including rates, thresholds, calculation methods, and key differences from employees.

Learn how to submit a Full Payment Submission (FPS) to HMRC in 2026, including deadlines, payroll data requirements, RTI rules, and how to avoid penalties.

Learn what an employer reference number (ERN) is in the UK, what it looks like, where to find it, and when you need one for payroll and PAYE admin.

Understand the difference between cumulative & non-cumulative tax codes. Ensure your UK payroll is accurate & HMRC compliant for 2026 & 2026/27.

Understand the PAYE reference number (ERN), learn where to find it, how to register as an employer with HMRC, and why it matters for payroll compliance.

Learn about the key National Insurance changes in 2026 affecting UK businesses, including employer rates, thresholds, and the Employment Allowance.

See what's new in PayFit

New features to save you time and give you back control. Watch now to see what's possible