UK National Insurance Classes Explained

As a UK employer, it’s crucial to understand the different kinds of contributions you’re required by law to make. One such contribution is National Insurance (NI).

This guide will take you through everything you need to know about National Insurance in the UK — what it is used for, an explanation of National Insurance classes, the rates and thresholds for each class, and so much more.

Let’s dig in.

What is National Insurance?

National Insurance (NI) is a contribution paid by UK employers, employees, and self-employed that counts towards certain benefits. Such benefits include State Pension, maternity allowance, bereavement support payment, etc.

The right to these benefits depends on an individual’s National Insurance class (we’ll explain what National Insurance classes mean later).

As a UK employer, you’re expected to make your employee’s National Insurance contributions through the Pay As You Earn (PAYE) system. First, you’ll have to deduct from each employee’s gross salary (based on how much they earn) to make the National Insurance contribution.

In addition, you’ll also need to make an employer National Insurance contribution for each employee.

All your contributions go to HM Revenue and Customs (HMRC).

Expectations as an employer

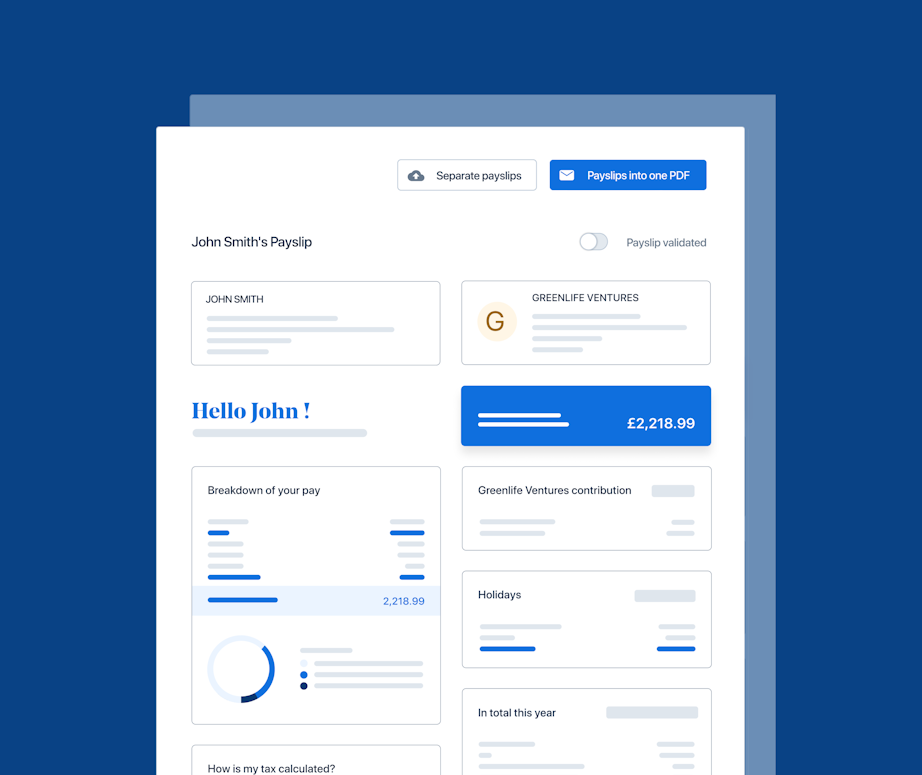

After making the National Insurance contributions, you’re expected to provide your employees with a payslip that shows how much NIC and tax deductions were made on their wages.

It’s crucial to make accurate deductions, as employees can report you to HMRC if they believe you made inaccurate deductions.

UK employees are expected to start paying towards their National Insurance from age 16 till they reach the state pension retirement age. You don’t have to make any more contributions if you employ people who have passed the state pension age.

When was it introduced?

National Insurance was introduced in the UK through the National Insurance Act of 1911.

In its early days, National Insurance was designed as a welfare system to offer insurance for workers who lost their jobs or became ill (and thus unable to work). Since then, National Insurance has evolved and now includes retirement pensions and other benefits.

What is a National Insurance number?

A National Insurance number (NI Number or NINO) is a number issued to every individual born in the United Kingdom. The HMRC typically assigns the NI Number before an individual turns 16.

Individuals who moved to the UK after birth can apply for their National Insurance number through the Department of Work and Pensions (DWP) if they want to be entitled to benefits after reaching the state pension age.

The point of the NI Number is to ensure an employee’s tax and National Insurance contributions records are made solely in their name.

A NI Number follows this format: It begins with two letters, followed by six digits, and finally ends with another letter.

Here’s what a sample NI Number might look like — AB 12 34 56 C.

You can typically find the National Insurance number on the P45 and P60 forms.

For the prefix, none of the letters can be D, F, I, Q, U, V. The letter O can only be used as the first letter of the prefix. Furthermore, the prefixes BG, GB, NK, KN, TN, NT, and ZZ are unallocated and not expected to be used.

For the suffix, only the letters A, B, C, and D are to be used.

What is it used for?

The primary purpose of National Insurance is to create a pool of funds UK workers can access after they become eligible for State Pension.

As you, the employer, make National Insurance Contributions (NICs), you’re helping your employees build and protect their entitlement to several benefits. These benefits include:

Maternity Allowance

Jobseeker's Allowance (JSA)

Employment and Support Allowance (ESA)

Bereavement Benefits

Basic State Pension

New State Pension

How much is National Insurance?

There’s no fixed amount of National Insurance to pay. Several factors — such as your employee’s employment status, how much they earn, and their National Insurance class — determine how much National Insurance to pay.

There are six different National Insurance classes — Class 1, 1A, 1B, 2, 3, and 4.

As an employer, you should be most concerned with the 1, 1A, and 1B classes of National Insurance.

What is Class 1 National Insurance?

Class 1 National Insurance (or Class 1 NIC) is paid by the employer and your employee.

Your employee’s contribution to the Class 1 NIC is known as the “primary contribution,” while your contribution as the employer is known as a “secondary contribution.”

As mentioned, your employee’s contributions should be automatically deducted from their gross pay based on how much they earn.

There are thresholds (Lower Earnings Limit, Primary Threshold, Secondary Threshold, and Upper Earnings Limit) and rates you need to know to determine how much National Insurance contributions to deduct from each employee’s gross pay.

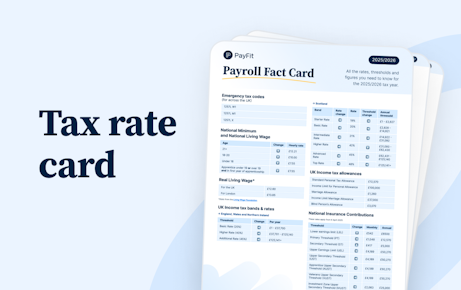

Class 1 National Insurance rates & thresholds

Here is what the different thresholds mean:

The Lower Earning Limit (or LEL): National Insurance contributions are not deducted from employees who earn below the LEL. Neither are these employees entitled to any benefits. The LEL for 2025/2026 is £125 per week, £542 per month, and £6,500 per year. NICs are also not deducted from employees who earn upwards of the LEL but between the primary threshold. Instead, the government gives these employees “credits” that allow them to still be entitled to benefits even though they don’t earn enough.

The Primary Threshold (PT): Employees start to pay National Insurance when their earnings reach the primary threshold. For 2025/2026, the PT is £242 per week, £1,048 per month, and £12,570 per year. The same applies for company directors.

Secondary Threshold (ST): This is when employers start paying NI. You’re expected to pay 15% on each employee’s wage that exceeds £96 per week, £417 per month, and £5,000 per year. These contributions are in addition to the ones your employees already make.

Upper Earnings Limit (UEL): Employees pay a lower rate (2%) on their earnings at this point. The UEL is £967 per week, £4,189 per month, and £50,270 per year. Even though the rate is lower for employees, employers still pay 15% on earnings above the upper earning limit.

Visit GOV.UK to stay updated with any changes to the threshold limits and rate.

What is Class 1A National Insurance?

Class 1A National Insurance contributions are made if you offer your employees any benefits based on their employment.

The Class 1A NIC is usually a percentage of the monetary equivalent of your employee’s benefit. This monetary value is also what is expected to be reported on your P11D form.

The percentage rate for the 2025/2026 tax year on Class 1A NICs is 15%.

What is Class 1B National Insurance?

Class 1B NICs are made by UK employers with a PAYE settlement agreement allowing you to make a yearly payment to cover all your tax and NI due on minor/irregular/impractical expenses or employee benefits.

These expenses and employee benefits include but are not limited to telephone bills, incentive awards, employee travel & relocation expense, staff entertainment, personal care expenses, and so on.

With the PAYE settlement agreement, you’ll no longer have to include these expenses in the annual P11D forms or pay Class 1A National Insurance.

Employers are expected to make Class 1B NICs payments on or before 19 October.

Like Class 1A NICs, the percentage rate for the 2025/2026 tax year on Class 1B NICs is also 15%.

What is Class 2 National Insurance?

Class 2 National Insurance contributions are for self-employed individuals who earn over £6,725 in profit yearly. These individuals pay a fixed weekly amount of £3.45 (or £179.40 per year) through a Self Assessment tax return.

All Class 2 National Insurance contributions also go to HMRC and help individuals build entitlement to benefits.

Individuals stop paying Class 2 National Insurance after reaching the State Pension age.

What is Class 3 National Insurance?

Class 3 National Insurance signifies voluntary contributions from individuals who want to fill or avoid gaps in their National Insurance records.

These gaps could result from unemployment, relocation outside the UK, or low-paying employment.

So to avoid reduced State Pension and benefits, individuals can top up their State Pension entitlement.

The maximum Class 3 NIC one can make is £17.45 per week.

What is Class 4 National Insurance?

Class 4 National Insurance (Class 4 NIC) is similar to Class 2 National Insurance, except that in Class 4 NIC’s case, the profit threshold is upwards of £12,570 a year.

For the 2025/2026 tax year, the Class 4 NIC’s rate for profits between £12,570 - £50,270 is 6%. While the rate for profits above £50,270 is 2%.

Individuals stop paying Class 4 National Insurance from the start of the tax year (6 April) after reaching the State Pension age.

How Payfit can help

A payroll software like PayFit can help you record employee details, calculate how much National Insurance contributions and tax to deduct from each employee’s pay, report payroll information to HMRC, and so much more.