An Introduction to Payroll Automation

In a world of exciting new technology, payroll automation could help unlock greater time, energy and efficiency for your business.

Payroll is a core part of every UK business. Employees expect to be paid accurately and on time. For those handling payroll, HR or operations more generally, there’s a lot that goes into preparing payslips and making prompt submissions to HMRC.

Learning how to run payroll properly in the UK takes time and effort. That's why so many businesses are turning to automatic payroll to get the job done. In this introduction to payroll automation, we’ll look at the systems and processes associated with automated payroll software and what can or can’t be automated. We’ll also look at the advantages of this new technology and how this compares with a more manual approach.

What is automatic payroll?

Simply put, an automated payroll system is a piece of software or technology that helps improve your payroll process by streamlining a number of the processes associated with payroll. These include:

paying employees,

submitting information and payments to HMRC, and

generating reports and calculating pension contributions.

What is the difference between manual and automated payroll?

Manual payroll involves the calculation and preparation of employee pay and payslips without much help (if any at all) from software.

Let’s paint a picture of what that looks like. Most small business operations will manage payroll from a set of spreadsheets and calculate pay using their own ‘home-grown’ formulas. Data is inputted piece-by-piece, and payslips are emailed out individually.

While this might look slightly different, depending on the business, the premise is the same - there’s a lot of time and mental energy required.

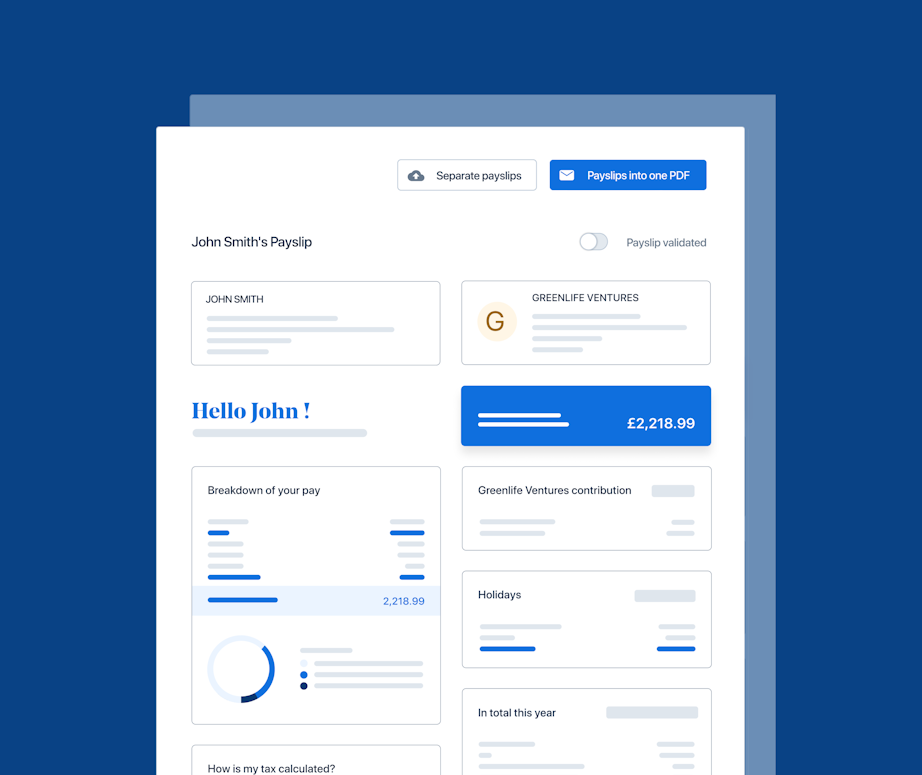

An automated payroll system, on the other does all the uploading, sorting and calculating for you. You can bulk upload all of your data into a secure cloud-based space, which crunches the numbers there. The system then generates payslips for you and sends these out to employees automatically. And hey, presto, it's done! Some software can even help you manage other People tasks for some additional HR transformation such as recording leaves & absences or templating your onboarding process.

Here are some key features to look out for in automated payroll software…

What are the common features of an automated payroll system in the UK?

Every provider will offer different features based on the capability of its associated platform; however, core payroll automation usually centres on the streamlining of several HR and finance-related tasks. They are:

Running payroll

At a minimum, an automated pay solution can help you do things like edit pay, add starters and leavers, and adjust pension contributions and salaries (say in the case of someone receiving a promotion). Once you input the data, the system will instantly update payslips and company records.

Making RTI Submissions and payments to HMRC

Any payroll software worth its salt should automate HMRC RTI submissions for you. The tax authority is particularly strict about deadlines for tax and deduction information, so this can be a lifesaver. PayFit, for instance, sends all FPS, and EPS submissions by deadline to HMRC.

Managing leave and absences

Automating parental, sickness and holiday pay calculations might sound like a real bonus, but it can result in huge time savings, so it’s a feature to take seriously. Find a good auto payroll system that can do this while also updating payslips and allowing employees to request leave.

Expense management

Expenses are another area worth streamlining. And it makes sense for payroll software to do some of the heavy lifting here. Choosing a system that allows employees to submit and get their expenses approved while uploading their receipts is one way to end the receipt chase.

Performance management

As you may have noticed already, some of the features we’re exploring are taking us into HR territory. That's because Payroll and HR really go hand-in-hand. And, while you want software that can do the payroll part (very) well, it’s also not a bad idea to look at what other HR tasks and duties it could cover. Especially if it comes with a handy employee portal (like PayFit does).

If payroll software comes with a few additional performance management tools, like 1-2-1s and review & feedback campaigns, it can help you expedite that work even more.

Reporting

Finally, one of the major benefits of payroll automation is how easy and accessible it makes managing employee data. In a nutshell, any data you run through your software you should be able to pull back out as a report, offering insight into your people and their data.

Other associated features you can expect with auto payroll include the ability to award backdated pay, rework payslips, utilise multiple different payment methods (e.g., BACS, CHAPS, pay on demand etc.), and manage off-payroll workers.

So to sum up so far, an automated payroll system can take these traditionally time-consuming tasks and make them happen automatically or within minutes using a few clicks. The biggest USPs of payroll software are that it eliminates mistakes and drastically reduces the time drain on HR and finance teams each month.

In order to find the features that will work best for your business, we recommend taking a look at our payroll software guide.

Payfit top tip 🚀

A key component of any automated payroll system are the pay calculations. Once certain elements are added into the system pension contributions, income tax , National Insurance and other deductions such as student loan repayments are calculated automatically pre-payday. Expenses , too, can pulled across to the employee’s payslip and automatically included within net income calculations.

What are the advantages of payroll automation for UK businesses?

By now, you should be starting to see how automated payroll systems can save your business time and stress, not to mention the other benefits we’ve alluded to. So, let’s consolidate and expand upon some of these benefits.

Greater efficiency

Managing payroll and all of the tasks that come with it by hand requires a lot of time and people power. Payroll automation and its ability to calculate and process many of those elements instantly drastically streamline the function and reduce time taken.

Fewer mistakes

Everybody makes mistakes, and the risk of errors is increased with vast and varied datasets requiring constant manual calculations. Using automated payroll software eliminates this from the equation. Plus, many providers offer variance reports highlighting errors early, allowing them to be quickly resolved ahead of pay runs or HMRC deadlines.

Timely, accurate pay

A legacy approach dictates that your accountant or payroll team pay employees manually by BACS. Payroll automation, by its very nature, ensures that employees are paid each time on the specified day and that the amount will be accurate.

Automated regulatory compliance

Automation ensures that RTI submissions and payments are made to HMRC on a specific day each month, meaning that teams don’t have to worry about doing it manually or incorrectly. This ensures regulatory compliance and reduces the risk of penalties for late payments.

Greater visibility over data

The ability of payroll software to take any information it holds and create a report in seconds allows HR and finance teams an unprecedented level of insight and visibility over financial and employee data. Using an accountant, on the other hand, makes this process difficult and time-consuming, often with a lot of back and forth to get the required information.

Improved strategic thinking

Having this level of data insight gives managers the power to make sound business decisions. Additionally, by freeing up days of time each month, automated payroll software allows managers the time to focus on more strategic, longer-term initiatives around recruitment, training and growth.

Gives power to your employees

As we explored already, good payroll software will give employees their own logins, enabling them to access information such as payslips, annual leave entitlements and performance reviews without having to ask somebody else for it. This reduces the burden on management and promotes trust within your organisation.

How can I automate payroll?

We’ve spoken about what payroll automation is and the benefits it can bring to your business.

So, how do you create an automated payroll system that can support your company as it grows and scales? The answer is that you really don’t have to create anything from scratch at all, as there are so many already-made solutions the UK market offers, including payroll software.

Start by auditing your current processes. Are they efficient? Do they require your team to spend hours on basic payroll tasks instead of focusing on higher-value projects? A review of your current systems and processes should reveal any weaknesses or blindspots your team has with payroll and identify common places within your workflow where errors tend to crop up.

Automate your woes away with payroll software

As we just mentioned, one of the most popular solutions for automating your pay run is with payroll software. And when it comes to automating calculations, workflows and procedures, PayFit’s software ticks all the boxes

We automate over 90% of the payroll-related tasks, including:

✅ sick and holiday pay calculations

✅ RTI submissions and HMRC payments

✅ pension submissions for major UK providers

✅ benefits reporting and processing

✅ bank files and employee payments

✅ leaves and absences

✅ expenses

✅ payslip generation

Keen to find out more? Then why not book a demo with one of our friendly product specialists to see what else PayFit could automate?