A guide to National Insurance for company directors

National Insurance is calculated slightly differently for company directors to standard employees and sole traders.

In this guide we’ll define who is classed as a company director, what class of National Insurance company directors are liable for, the two methods for calculating how much NI directors pay, and how to choose the right calculation method for your business.

So without further ado, let’s delve into the subject of National Insurance for company directors.

Who is classed as a company director?

As far as NI is concerned, a company director is defined as either:

a member of a board or similar body where the company is managed by a board or similar body, or;

a single person where the company is managed by an individual.

In either case, if the person in question is accustomed to acting under the instructions of another person, that person will also be classed as a director. However, this won’t be the case if this other person’s instructions are limited to professional advice (e.g.: a solicitor).

It’s worth noting that directors of non-demutualised building societies aren’t normally classed as company directors when it comes to NIC calculations.

If you’re unsure, HMRC’s CA44 booklet lays out detailed guidance on this, and many other, NI for company directors topics.

Do company directors pay National Insurance, and what are they liable for?

In short, yes, company directors pay National Insurance. A director’s NI category works in the same way as other workers or employees, insomuch as their letter is based on their own personal circumstances and age. For NICs purposes, a company director is classified as an office holder, and they are therefore liable for Class 1 NICs on earnings.

How you should calculate National Insurance for company directors

Despite many of the supposed intricacies around calculating NI for company directors, including those eligible for Freeport, Investment Zone or Veterans NICs relief, there are just two methods that can be used to calculate a director’s NI:

Per pay run / non-cumulatively - Matching the method used to calculate NI for regular employees and workers, in this instance the director pays NI on earnings over the primary threshold in each pay period. However, in the final pay period of the tax year, National Insurance is recalculated on a cumulative basis to ensure no under or overpayments have been made.

Cumulatively - This looks at annual, rather than per pay period, thresholds. So NI is calculated cumulatively throughout the full tax year. National Insurance is only paid by the director once they exceed the annual primary threshold.

Whichever method is chosen, there’ll be no difference in the NI contribution amount paid come the end of the tax year. The only thing that will vary is the distribution of contributions throughout the year.

Choosing the right calculation method

There’s no right or wrong way here - it’s completely at the discretion of the company director(s) in question to choose the method they prefer. Having said this, there are some factors to take into consideration when choosing. For example:

The chosen method remains in place until the end of the tax year if the director resigns from that role, but remains an employee of the company within the same tax year

Once a method has been applied in one pay period, this will remain in place for the remainder of the tax year

If opting for the cumulative / annual method, NI may not be paid in the first few periods of the year, and earnings may change on each payday

If using the non-cumulative / per pay run method, NI contributions are recalculated on a cumulative basis, either in the final pay period of the tax year or the final one before they leave (if applicable). This ensures that the correct level of contributions are made, and only applies to directors not employees.

Something to be mindful of...

Annual thresholds are prorated based on the number of weeks somebody has been a director in that tax year. For example, if the director started at the company, or became a director, in week 26 of the tax year, the annual thresholds are divided by 52, and multiplied by 26.

The cumulative method explained

Directors who choose to calculate their NI contributions cumulatively can usually earn up to the annual primary threshold, which is £12,570, before any NI is due.

In the 2023-24 tax year, they would’ve paid National Insurance at 11.5% on earnings above this primary threshold until the upper earnings limit of £50,270 was reached, and then 2% of any earnings above this.

From 6th April 2024, and for the remainder of this tax year, the 11.5% figure has changed to 8%, in line with employees and workers (for whom it was previously 12%).

These figures are for NI category letter A, so be sure to consult the category letters link which we shared earlier for the full rundown.

Using PayFit to calculate National Insurance for company directors

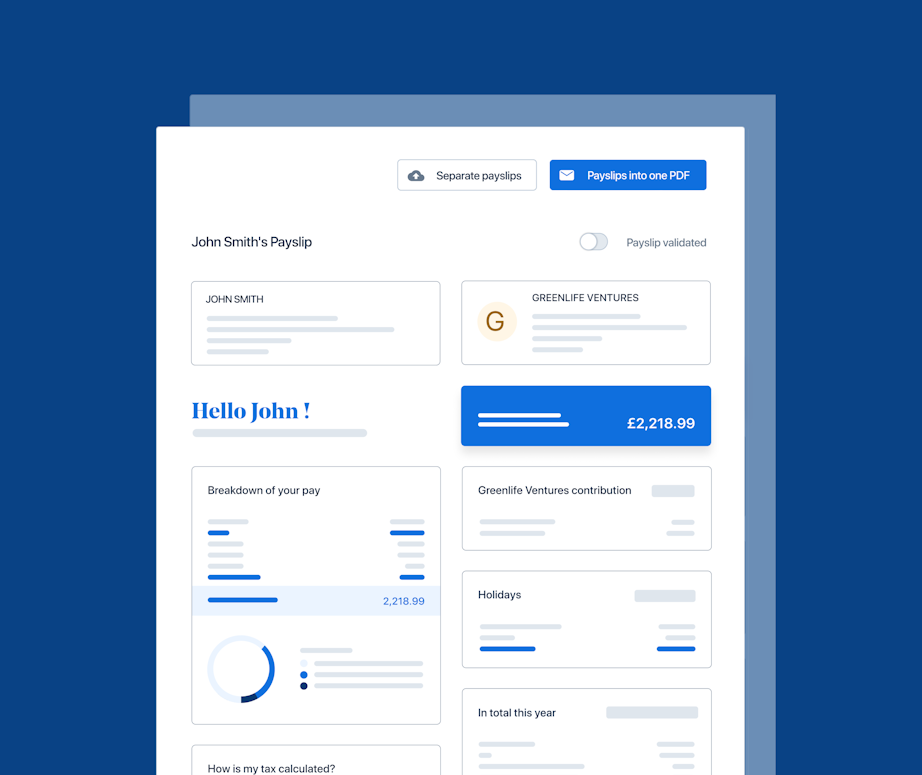

A key way in which PayFit helps small businesses drastically reduce the amount of time spent on payroll related matters is by automating fiddly calculations. This includes National Insurance. Handily, rates for the forthcoming tax year are coded into the platform at the end of the previous one, so there’s never any doubt that the calculations made to employee and director payroll are the right ones.

In employee records within their PayFit dashboard, company admins are able to specify whether or not that employee is a company director, as well as which calculation method should be used.

It’s then a matter of hitting ‘Save’, and everything else is done automatically, with payslips as well as the EPS/FPS records updating in real time. PayFit even creates these submissions automatically, collating them in a handy reporting section that lets you know the amounts due to HMRC plus the payment deadlines.

And how about our coveted payslip breakdown feature, especially valuable for directors? It shows the thresholds used in the calculation, the rate in each threshold, the amount of NI due at each threshold, as well as the total amount of NI. There are two breakdowns - one for employees, and one for the employer. Pretty handy right?

Isn’t it time you looked into using PayFit to help calculate and oversee National Insurance for your directors and employees?