Running Payroll 101: Step-by-Step Guide For New Businesses

Running payroll for the first time in the UK might feel a little daunting. After all, it’s a major step in your quest to become an all-singing, all-dancing business! However, like most things in life, once you’ve done it, it gets a little easier.

Paying your employees correctly, of course, is essential. It’s also a legal requirement here in the UK. And, there are a number of steps you should work through each month so you comply with all of HMRC’s reporting and payment requirements.

Read on for the lowdown on how to run payroll for your small business. We’ll outline the steps needed to successfully complete a payroll run each month (or your chosen pay period), along with any costs of running payroll.

What does running payroll mean?

In a nutshell, your payroll is a list of all your employees and what you pay them. It includes salaries, bonuses, allowances and benefits. Deductions - including income tax, National Insurance, pension contributions and student loan repayments - are also included as part of your payroll.

What we’re referring to here is the act of paying the people on that list at the same time as making the appropriate deductions, that is, paying what is owed to the relevant bodies and reporting your payroll activity to HMRC.

What payroll system is used in the UK?

In the UK, the Pay-As-You-Earn (PAYE) system is how you deduct Income Tax and National Insurance Contributions (NICs) from an employee’s wages. You’ll also need to use this system to process pensions. In other words, you’ll need to calculate and deduct the right amounts from each employee’s pay pack so you can report and make these payments to HMRC.

What are the different ways of running payroll for your company?

Whilst the steps will be broadly the same for all companies, there are several different ways you can administer payroll each pay period.

First, there’s the spreadsheet method. While it’s certainly the cheapest way to run payroll, it’s a little ‘old school’ (not to mention time-consuming). You’ll need to calculate everything yourself using formulas, and mistakes are bound to slip through the net (which your employees and HMRC won’t be too happy about).

Alternatively, you can have an outsourced specialist, like an accountant or payroll bureau, handle payroll for you. Having payroll literally lifted off your plate can feel amazing, especially as a new business. But as you grow, cracks will start to show, such as miscommunication and additional charges for changes like new starters, pension adjustments, bonuses, etc (not so cool).

Finally, there's the option of online payroll software. This can automate large parts of your process, including payment calculations and deductions based on inputting a gross salary. It also allows you to have better ownership over your entire payroll process. The best software will generate reports for HMRC in the correct formats in a jiff, so you’re always compliant.

How to run payroll in the UK for the first time - a step-by-step guide

If it’s your first time running payroll, you might not be super familiar with all the steps involved, especially if you’re running payroll by yourself - sans assistance from software. So, let’s walk through some of the basics of how to run payroll manually.

Be sure to give our payroll best practices blog a read too, so you can apply good principles at every step.

Payfit Top Tip 🚀:

Keep in mind, while this information might be helpful, there’s no real substitute for real professional advice. Use these steps as a guide, but if you need additional help or advice, be sure to seek this out before your first pay run.

Register with HMRC

If you’ve not yet hired your first employee, you’ll first need to set up payroll. In other words, you’ll need to register as an employer with HMRC. The good news is you can do this anytime in the eight weeks leading up to when your employees are owed their first paycheck. Though it’s worth noting, it can take up to 15 days to get your employer PAYE reference number, so you’ll want to leave time for all that paperwork processing.

There are other things you’ll need to do, such as setting up a pension scheme and establishing a solid onboarding process so you’re gathering all the right information from new hires. For a more indepth look at how you can set up payroll, check out this small business guide on how to set up a payroll process for the first time.

Decide when to pay your employees

Once all this is sorted, you’ll want to agree on dates for paying your employees. Most companies will choose to pay employees on or around the last day of each month, so 12 times a year. This is the recommended frequency that aligns with HMRC reporting requirements, as well as most payroll software. That being said, there are alternatives to this, such as paying salaries every four weeks or on a bi-weekly basis.

Legislation bytes🧑⚖️:

It’s worth noting that the tax month for HMRC begins on the 6th of the month and ends on the 5th of the following month, which makes running payroll on a monthly basis a more practical option from a compliance point of view.

Calculate and record gross wages

Now, you’re ready to run payroll! How exciting. That is, if you’re confident in what you’re doing (...if not, no worries - we’ve got you covered). The first thing you’ll need to do is determine your employee’s gross salary or wages. To do this, take each gross salary and divide it by the number of times you’re planning to run payroll. So, if you’re running payroll on a monthly basis, that’s twelve times. Don’t forget any additional overtime, commissions or holiday pay for that month.

If you are using payroll software, the gross employee pay would be entered into the system once, with all deductions calculated automatically every time you do your pay run, even when tax codes change. If opting for the more manual method, then it’s time to move onto the next step.

Make pre-tax deductions

Next, you’ll need to make pre-tax deductions from the gross amount yourself. Thankfully, we’ve built a handy salary calculator which will break down and illustrate each element for you. These are:

National Insurance (the employee portion): There are different National Insurance ‘classes’, meaning that those with differing arrangements, for example, self-employed, if you offer benefits etc., will be liable to differing amounts of National Insurance. In addition to the employee portion deducted from gross salary, you’ll need to pay the employer amount

pension contributions: These are split into two amounts, one being a percentage of the gross salary that you will contribute towards the employee’s pension scheme as a business, and the second being the amount that will be deducted from their final pay;

student loan repayments: If they are applicable, that is. You can shave this off as a percentage of the gross salary, dictated by how much that employee earns or whether or not they took out a student loan in the first place.

Deduct income tax

Following this, you’ll need to calculate the amount of income tax you need to deduct from gross pay. Here, the amount of salary paid will determine the income tax bracket that employee falls under and therefore, what percentage they’ll need to pay. Again, this is another thing payroll software can automatically do for you.

If you are paying your staff member a bonus, you’ll deduct and record the tax on that benefit at this stage too.

Time for those post-tax deductions

Up to this point, we’ve been dealing with pre-tax income. Now, we’re getting very close to the amount you’ll be able to pay your employees. But before you go sending out those payslips, there’s one more thing you’ll need to check: and that’s post-tax deductions.

Here, every employee is unique. Some might have student loan repayments, others child support payments. Most will likely have a pension contribution. Whether or not these types of deductions apply will depend on the person. You’ll want to take all of these out of the equation (quite literally) at this stage).

Legislation bytes🧑⚖️:

Ok, so we fibbed (a little). Reality is a little more complicated - but in the spirit of providing a nice, easy-to-follow checklist, we simplified it. Not all of these deductions should be made post-tax. Some of these will need to be made after you’ve withheld taxes and NICs. It’s important to find out how you should calculate these specific deductions - seek out some guidance if you’re not confident.

Pay your staff!

After all that, you’re ready to pay your staff (e.g. your employee gets to keep the rest!). At this stage, you’re ready to send out your payslips. These should contain certain information by law, such as the employee’s gross and net pay and the total amount of deductions you’ve made.

Be sure to know exactly what’s been taken out beforehand, as this will need to be reported to HMRC in an itemised fashion. And, when it comes to sending the relevant payments to them, you’ll want to know how to be able to reconcile those costs against your company accounts.

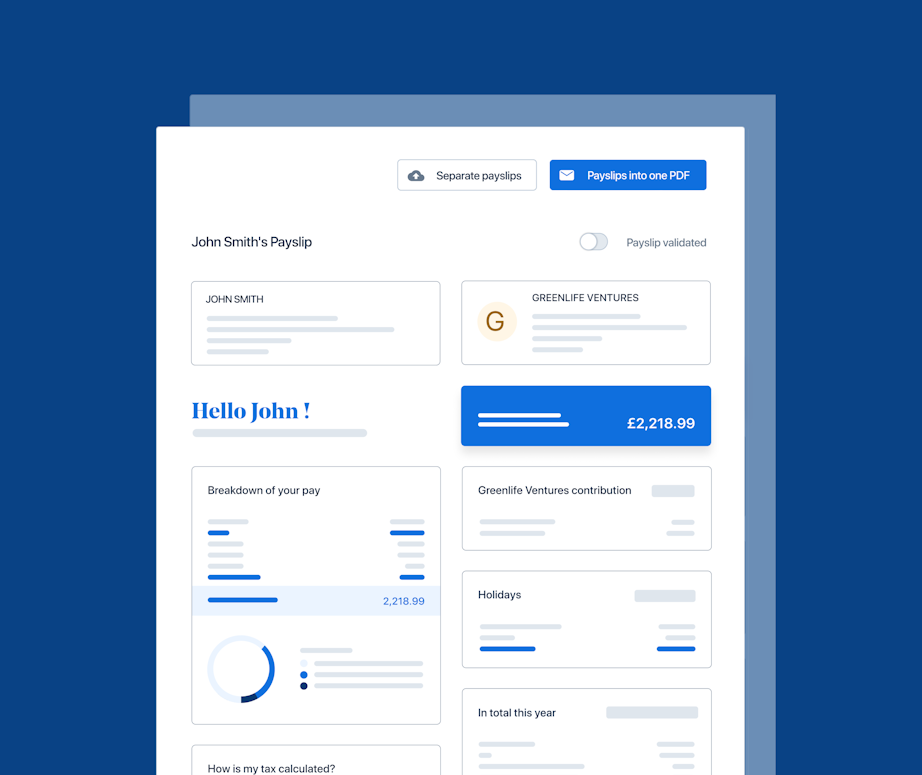

Most payroll software generates payslips automatically - one less thing to worry about each payday.

Send reports of what you’ve done to your staff and HMRC

Last but certainly not least, you’ll need to let HMRC know what you’ve paid each employee, including taxes and deductions, as well as the company as a whole. This is what’s known as Real Time Information, or RTI. And there are two elements to this - a Full Payment Submission (FPS) and Employer Payment Submission (EPS). Both need to be sent to HMRC by a particular date each month, with any payments due following soon after.

Check out our article on RTI for a full breakdown of your responsibilities as an employer, and to help you remain compliant at all times.

And there you go - a high-level summary of everything you need to in order to run payroll each and every pay period!

Now, let’s turn our attention to the costs involved…

How much does it cost to run payroll in the UK?

How much it costs to run payroll depends on a number of factors. Usually, the determining factor is how many employees you have, as payroll providers - software-based or otherwise - tend to charge a per-payslip fee. Outsourced providers such as payroll bureaus and accountants often charge additional fees for every new starter added onto the system, as well as to create documents such as P45s, P60s and P11Ds (for benefits reporting) (which is a bit annoying).

You should always be very clear as to any additional costs of running payroll, so be sure to ask this of your prospective software, accountant or bureau at the initial consultation stage.

How much does it cost an employer to pay an employee in the UK?

The cost of paying an employee’s salary comes down to the taxes you have to pay on this. For instance, most employers will need to pay 13.8% of an employee’s qualifying earnings in NICs (given that most employees fall under National Insurance category A).

You can find out more about how much tax employers need to pay for employees in the UK by reviewing our blog on UK payroll employment tax.

Running payroll: why use payroll software?

We’ve alluded a few times throughout this piece to the benefits of using an in-house owned payroll software to run everything yourself. A huge benefit is the speed with which everything can be done, with very few manual inputs. For example, calculations (automated), the generation of payslips (automated), the collation of liabilities for reporting to HMRC (automated) and the creation of documents such as P45s, P60s and other employee forms (all automated).

Weaved into the automation side of things is a far lower risk of errors (after all, the only point of manual data entry is for the gross salary). As a small and flourishing company, winning that time back in your day can be incredibly meaningful - leaving you more hours to spend on growth initiatives so you can get to where you want to go a lot quicker.

Above all, payroll software gives you control over your own company’s payroll destiny. Sounds dramatic, we know. But when you think about all the time and grief, you’ll save yourself going back and forth with an outsourced provider, constantly having to ask for things, and querying fees, it could very well be worth it.

Payroll software puts you (and your staff, through a limited access login) in the driving seat, empowering you to become a payroll whizz even with little to no knowledge of the subject.

Jump on a short demo with our team to learn about the wider benefits of payroll software and PayFit.