✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

LONDON, UK 8th September 2025 - British workers are the most confident in Europe when it comes to understanding their payslip, yet a quarter face confusion around tax deductions and pension calculations, according to new research from PayFit.

In a survey of 1,950 workers across Europe*, UK employees topped the table for payslip literacy, with 73% saying they fully understand their payslip - compared to 54% in Spain and just 29% in France, where payroll systems are significantly more complex**.

While British workers benefit from a simpler payroll structure, certain grey areas persist which many admit is making their daily lives more complicated. Nearly a quarter (24%) struggle to understand tax deductions, while 19% find pension contributions confusing. Being unable to spot underpayments also concerns 18% of respondents.

“These gaps show up in everyday decisions,” comments Firmin Zocchetto, PayFit’s co-founder and CEO. “When workers don’t understand their payslip, they’re left second-guessing whether they’ve been paid correctly, what’s gone into their pension, or how much tax they’re actually paying. This level of uncertainty can stall decisions - whether that’s applying for a mortgage, or simply figuring out if they can afford to book a holiday.

“Add evolving pension rules and warnings of tax hikes in this year’s Autumn budget, not only are we seeing employees face more complexity than ever, many are still relying on HR teams to interpret the basics.”

Despite these challenges, trust in employers remains high. 94% of UK workers believe their payslip is accurate (compared to 88% in Spain and 81% in France) and, when questions do arise, nearly half (47%) turn to their company’s HR or payroll teams for clarification, while 20% ask their manager. Just 6% use the web and only 2% turn to AI, perhaps pointing to a lack of trust in generic tools to explain something as personal as payroll.

Even when they do call on support from their employer, only 60% of British workers request an explanation at most two or three times a year. 15% never raise payroll questions at all. One in four need support more frequently - at least once per quarter - suggesting that while general understanding is solid, ongoing confusion still affects a significant share of the workforce.

Interestingly, French workers - despite facing more complex payslips - show similar patterns to their UK counterparts. Nearly 75% reach out to HR two to three times per year or less, and just 4% do so at least once a month. In Spain, 64% ask questions about their pay two to three times a year or less, yet a significant proportion (24%) seek help at least once a quarter, demonstrating a regular need for support among part of the working population.

The research also reveals key generational differences, with young British workers’ understanding of payslips is notably lower than the rest of the workforce. Those aged 18-34 face increased confusion when it comes to tax deductions (32% versus 24% overall), pension calculations (24% versus 19%), and payment verification (24% versus 18%).

This lack of understanding is reflected in how often they contact HR or their managers. Nearly a third (28%) contact them at least monthly, more than double the UK average (13%), while 38% do so between quarterly and 2-3 times per year (versus 27%).

The findings show little improvement from earlier this year, when a separate PayFit survey of over 2,000 UK adults found that 59% of 18-24 year olds didn’t understand their pay deductions and struggled to budget as a result. Nearly one in three (29%) said that clearer payslip information would help them make better financial decisions.

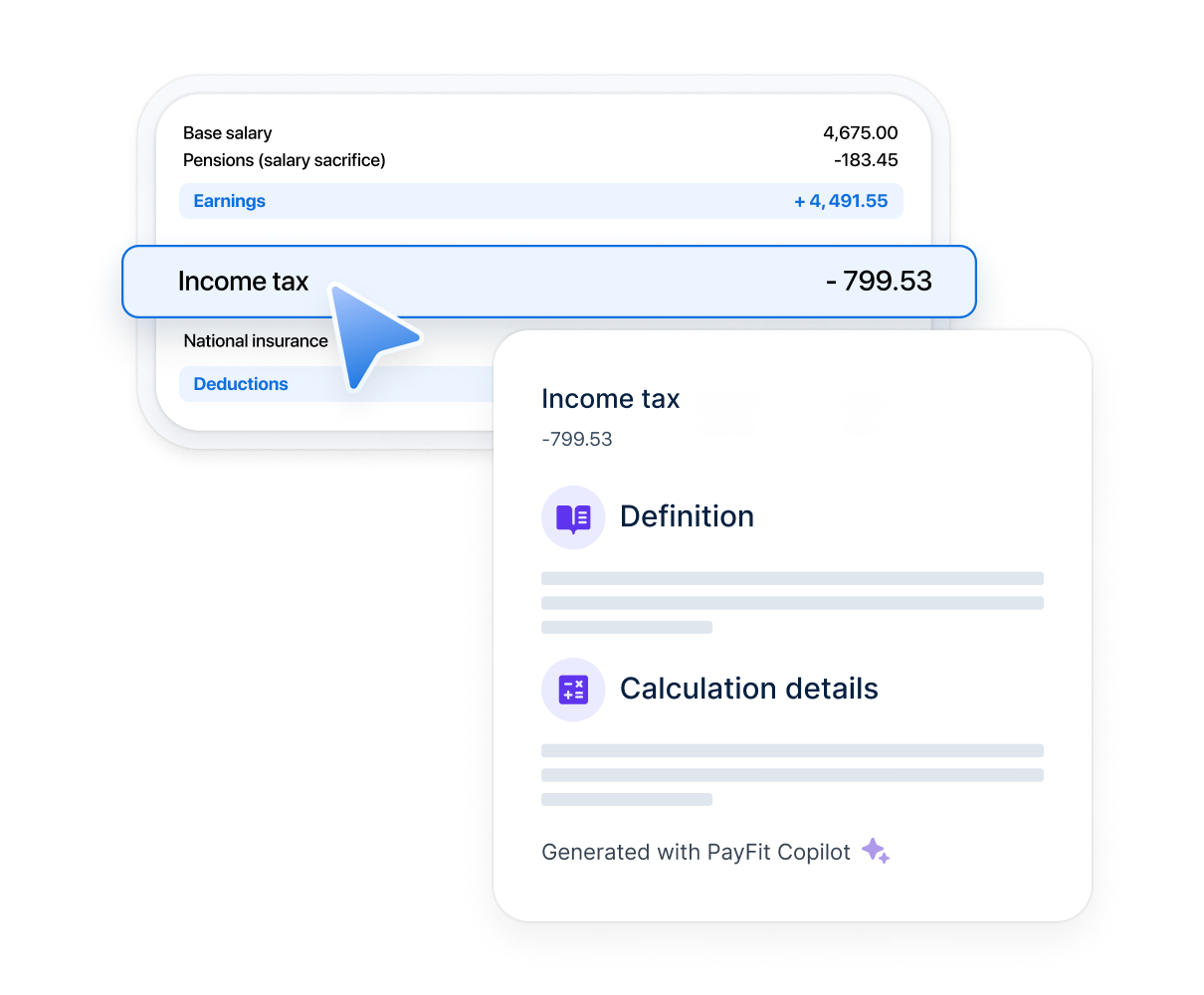

Firmin adds: “Payroll remains one of the major pain points in working people’s daily lives but, with the right tools, it is also one of the simplest to solve. Employees shouldn’t have to decode their payslip or rely on HR to explain it - this takes everyone away from more meaningful tasks. Employers need to make payslips clearer, more intuitive, and easier to navigate, which will help workers make better financial decisions. That’s why PayFit is introducing an interactive payslip so that every employee can fully understand their payslip.”

Editor’s notes:

* The survey was conducted online by Ipsos between 30th June and 1st July 2025. The sample comprised a representative sample of 1,950 European workers aged 18-65 years old (650 in the UK, 650 in France and 650 Spain).

** Sources on French payroll complexities:

In summary:

According to Alight, France tops the Global Payroll Complexity Index (GPCI)Several elements fuel the growing complexity of payroll in France, including tax variations, frequent legal updates, and complex local processes.

Tax variations represent one of the main challenges for payroll managers in France. Each year, new tax rules, deductions, and tax rates are introduced or modified.

Complex local processes are often linked to the specificity of industry agreements, collective bargaining agreements, and company agreements in France. Each business sector may have its own rules and standards regarding payroll.

About PayFit

Launched in April 2016 by Firmin Zocchetto, Ghislain de Fontenay and Florian Fournier, PayFit revolutionises and simplifies payroll and HR processes for growing businesses. Fast, intuitive and automated, PayFit offers all the tools you need to manage and pay your people seamlessly.

PayFit is present in the United Kingdom, France, and Spain and currently supports over 20,000+ companies in managing their payroll and HR function.

Learn how to create a payslip that is HMRC compliant. This guide for 2026 covers UK law, deductions, software benefits, and the risks of manual templates.

Confused by what's on your payslip? Our guide breaks down everything from gross vs net pay to tax codes & abbreviations for UK employees and employers.

Discover the benefits of online payslips and how this simple example of workplace tech empowers staff with paperless, email-free workflows.

Everybody loves payday. Seeing your bank balance topped up and knowing that there's money to burn. It's a good feeling, right? But what about the payslip itself? Could that offer more? Well, we at PayFit think it can!

See what's new in PayFit

New features to save you time and give you back control. Watch now to see what's possible