The importance of employees' financial education

According to research conducted by the Financial Conduct Authority (FCA), over 50% of UK adults are considered to be financially vulnerable.

While the results of this study predate the coronavirus pandemic, the subsequent job losses and overall economic uncertainty will have undoubtedly increased the prospect of more people running into financial difficulty.

In this article, we look at the importance of financial education and seek to understand the ways that employers can support their employees to become financially literate.

What is financial literacy?

Finance.

The word alone is enough to send shudders down someone’s spine. Its complexity can make it an unattractive subject for many, yet the importance of being financially literate should never be underestimated.

But what does it mean to be financially literate?

Well, according to the S&P Global Finlit Survey, someone who is financially literate has “the ability to understand essential financial concepts and make informed decisions about saving, investing and borrowing”.

Sounds basic enough then.

But without the right tools, advice and guidance, becoming financially literate may not be as easy it sounds.

Why is financial education important?

No matter their background, age, job title or even salary, financial education can have a positive impact on a person’s life.

Even those fortunate enough to be in a comfortable financial situation could one day find themselves in difficulty as a result of uninformed decisions.

Did you know?

There is a common misconception that it’s only the older and more vulnerable members of society who are susceptible to falling victim to fraudsters.

Research conducted by Barclays shows that employees aged between 18 and 24 are five and a half times more likely to fall victim to a scam than those over the age of 65.

According to the Money and Pensions Service, 11.5 million people in the UK have less than £100 in savings.

This is statistic may seem a little improbable at first; nevertheless, research released in 2020 revealed that an overwhelming 93% of Britons feel undereducated when it comes to their personal finances?

Financial education starts at school

Unfortunately, the current lack of understanding can be blamed largely on the school curriculum's glaring absence of financial management.

A 2019 survey published by the Financial Times revealed that an astonishing 80% of UK students aged 15-18 felt that they were not taught enough practical finance lessons in schools.

So how do people learn?

Sadly, it’s often the hard way.

The lack of education in schools and the subsequent absence of reliable guidance often mean that financial education takes place in negative life experiences.

This is particularly evident with young adults who are often more likely to focus on short-term spending rather than longer-term saving after entering the working world and being exposed to money for the first time.

The coronavirus pandemic has also demonstrated how poor financial management can leave people in difficult situations.

"With millions of UK workers facing the uncertainty of furlough and the possibility of redundancy, having an understanding and control of personal finances has never been more critical."

Chieu Cao, Mintago's Founder & CEO

How can employers support their employees?

The pandemic has highlighted the importance of employee wellbeing and forced many employers to reflect on how they can support their staff when working remotely.

But even before then, there was evidence to suggest that employers were making a concerted effort to implement wellness initiatives in their companies.

Wellbeing perks such as discounted gym memberships and access to yoga or meditation classes have become the norm for employers looking to demonstrate their support for employee wellbeing.

While perks such as there are great, they tend not to address the issues which generally impact employee wellness.

Research conducted by Close Brothers Asset Management revealed that 94% of UK employees suffered from money problems, while 77% said that financial concerns impacted their performance at work.

With finance issues impacting so many employees, companies have started to adopt wellness initiatives such as financial education that provide impactful and rewarding benefits to their staff.

The role of HR in employees' financial wellbeing

National Payroll Week took place between the 7-11 September. It was a great opportunity to start the discussion around the role of HR in employees' financial wellbeing.

We ran a webinar during which speakers from Mintago and Smart Pension shared their insights and views on improving employees' financial wellbeing and why financial education is key to achieving overall wellbeing and performance at work.

👉 You can watch a replay of the webinar HERE.

PayFit & Mintago

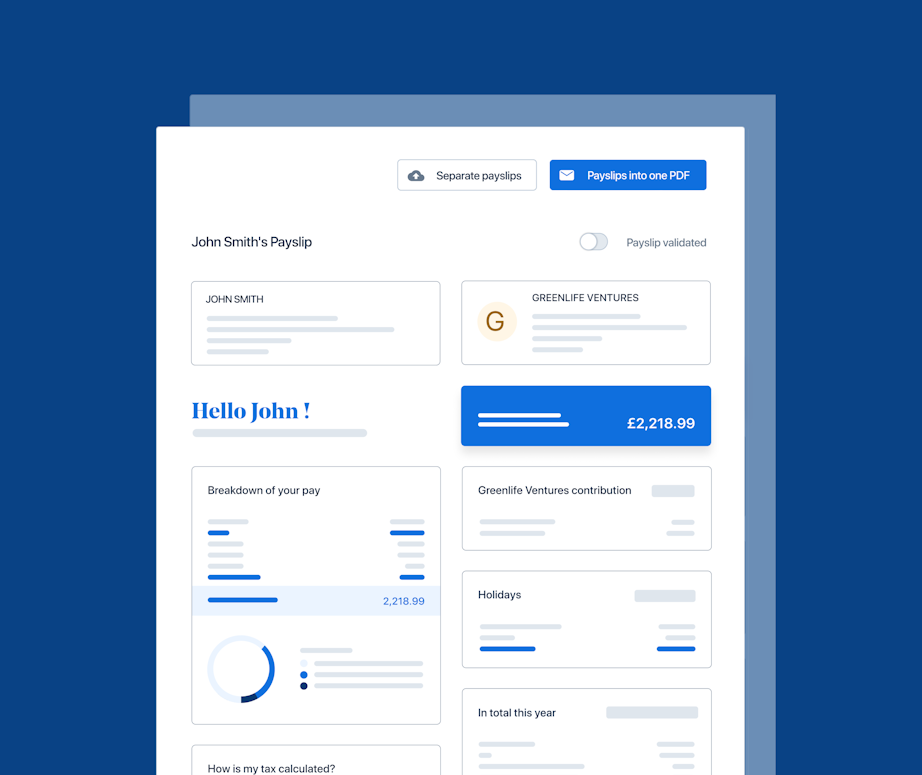

Mintago is a financial wellbeing platform that helps employees to become more financially confident.

The Mintago app doesn't only provide financial education; it also acts as a planning tool that helps support employees in achieving their long-term goals and a trusted hub where employers can post all the offers and benefits they already have to support their employees’ wellbeing.

We’ve teamed up with Mintago so you can get a FREE employee financial health assessment for your company.

All you have to do is fill in the form and an expert at Mintago will get in touch to run the assessment and provide you with your company’s financial health report.

“Mintago allows companies to support their employees and provide them with the foundations to achieve financial wellbeing.”

Chieu Cao, Mintago’s Founder & CEO

How To Work Out Hourly Rates In The UK - An Employers' Guide

Recruitment Process Guide - Stages, Selection, Automation

Employee Contracts - A Guide For UK Businesses

Part Time Workers' Holiday Entitlement - Guide & Calculator