Payroll Numbers, IDs & References - The essential guide for UK employers

Not to be confused with RTI numbers or references (unique identifiers used by HMRC to keep track of employee tax records), a payroll number (payroll ID or reference number) is used by UK employers to keep track of employees. They’re a unique set of numbers and letters which an employer can assign to each individual working at a company. They’re not a legal requirement in the UK, but can help protect employees’ personal information and reduce the risks of mistakes within payroll processes.

We’ll explain how payroll numbers can help contribute to data security, how they are created and formatted, plus things to be aware of, in this article for UK businesses.

What is a payroll number?

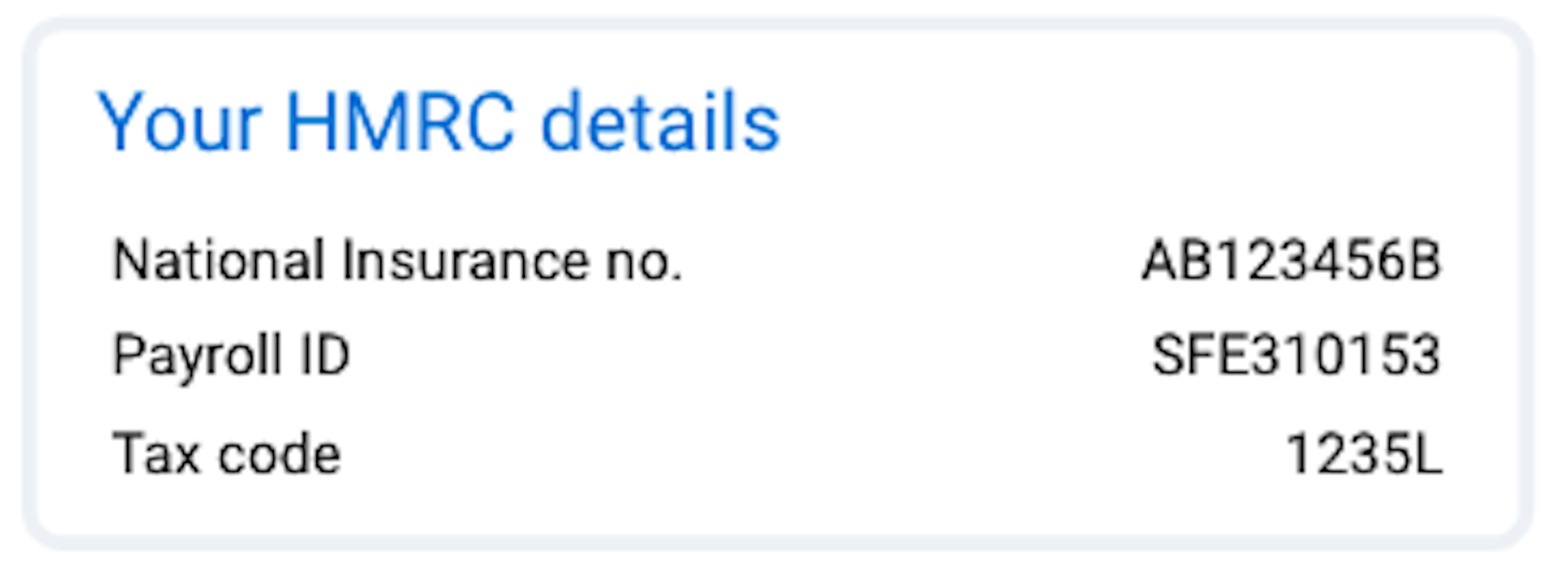

Payroll numbers (also referred to as payroll IDs, at least where PayFit payslips are concerned) are unique identifiers used by employers in the UK to identify their employees from a payroll perspective. Usually made up of numbers and letters, they serve as an added layer of protection to help pay your people securely. They help employers more efficiently keep track of payments and deductions made to and from employees and are often the same as the RTI number, which helps align your employee records with what HMRC has on file (more on this later).

What's new for payroll numbers in 2025?

Several important updates have been introduced for payroll numbering systems.

New RTI reporting requirements mandate more detailed payroll ID formats for accurate tracking

Enhanced data protection requirements for payroll number storage and transmission

Integration requirements with HMRC's modernised digital tax platform

Specific formatting requirements for multi-contract employees and secondary employment

New Real Time Information requirements affect how payroll numbers are used. For example, there are now additional payroll ID validation checks in HMRC's systems. Multi-site employers are obligated to include location codes in their numbers. Working hours now need to be reported alongside payroll numbers. There will be different formatting to consider for temporary and agency workers, plus enhanced requirements for correcting payroll number errors in RTI submissions.

How are payroll numbers created?

Payroll numbers can either be created and assigned manually by your internal team, or generated by your payroll software. If opting for the former approach, it’s advisable to employ a consistent format in creating the numbers. Some software automatically assigns consistently formatted payroll reference numbers, however this is something you should confirm with your prospective provider if opting to invest in payroll software.

HMRC's latest guidance recommends that employers use a combination of letters and numbers (a minimum of 6 characters), include the department or location identifiers where relevant, and avoid using sensitive data like birth dates or NI numbers.

Employers should maintain consistent formatting across all payroll systems and reports, and larger organisations are advised to include check digits for error detection.

What’s the difference between RTI numbers, PAYE reference numbers and payroll numbers?

The concepts of payroll, PAYE and RTI numbers are closely related, but crucially different for UK employers.

An RTI number is a unique identifier used by HMRC to keep track of employee tax records. It can usually be found in the FPS (Full Payment Submission). Like a payroll number, it’s something that is usually created and assigned manually by those responsible for payroll. It’s recommended, for consistency and ease of aligning everything internally and with HMRC, to have the same RTI and payroll number for each employee.

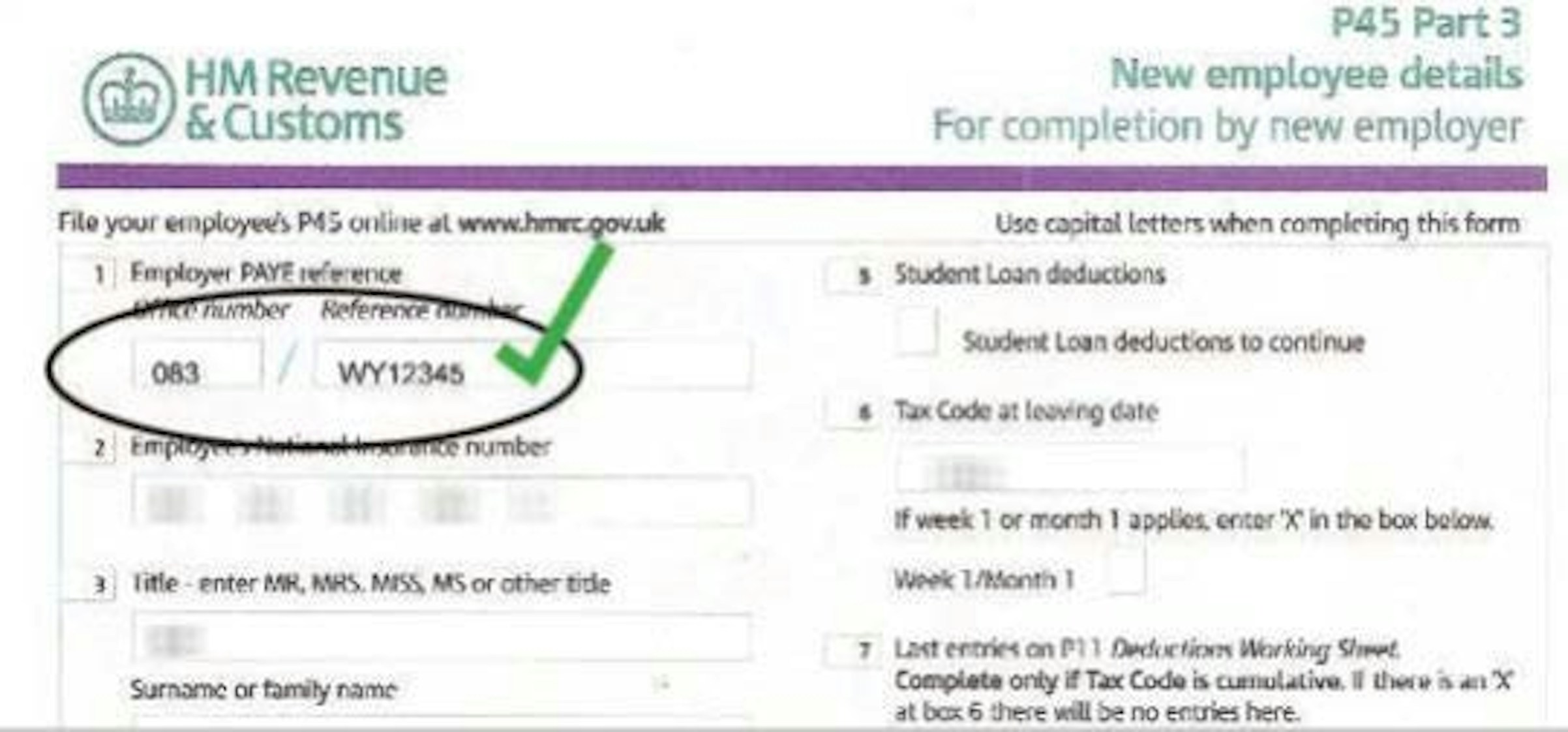

A PAYE reference number (also called the employer reference number, or ERN) is different as it’s assigned to businesses with employees automatically by HMRC. It consists of 3 digits representing the HMRC office dealing with your company, followed by several letters or numbers. It’s usually 10 digits in total, but there are sometimes exceptions.

What can payroll numbers also be known as?

You may hear them referred to as payroll IDs (our preference) or payroll reference numbers. As discussed above, the concepts are slightly different to both RTI and PAYE reference numbers.

What are some common payroll number issues to avoid?

There are a number of common issues which can occur. Identified incorrectly or too late, they can be difficult to amend and can lead to issues across your company payroll, for example an employee being paid incorrectly.

Particular attention should be paid to when an employee leaves and is later re-employed by the business. In this case, a new payroll number must be assigned to them. This is because a payroll number is issued on a per employment basis, rather than based on a singular person.

If you wish to, for whatever reason, update an employee’s payroll ID during their employment, it should be reported immediately to HMRC, as a duplicate record might be created which means HMRC incorrectly demands submissions and payment for the original, now defunct reference too.

How do payroll numbers help with data protection and GDPR?

Crucial employee details can be linked to a payroll number, for example name, contact details, job title, salary, and more. By linking such sensitive data to a simple payroll ID, this limits how much confidential information needs to be shared and stored across various different databases (particularly important for a multinational company). This therefore limits the amount of personal information that could be compromised by a data breach.

Recent security requirements demand heightened encryption standards for transmitting payroll data, plus a requirement that payroll numbers are masked in non-essential comms.

It’s worth noting that PayFit is an ISO27001 certified payroll software, meaning we conform to the highest standards of data protection and security. Two-factor authentication (2FA) ensures that only approved admins can access the entire company’s payroll data, whereas employees only have access to their own data and files.

Find out more about how we enshrine security and protection at every step of your payroll process by booking in a demo call with one of our product specialists.

Payroll number FAQs

Payroll numbers remain consistent during sick leave periods, but proper recording is essential for accurate payment calculations. Learn more about managing employee sick leave entitlement.

Yes, but specific formatting may be required for PSA submissions. Find out more about PAYE settlement agreements.

Overtime hours should be clearly linked to the employee's primary payroll number for accurate payment. Read our guide about calculating holiday pay for overtime.

No, existing payroll numbers should be maintained, but additional codes may be needed to track scheme participation. Learn more about holiday purchase schemes.