✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

Here’s are the key aspects to understanding your payslips:

Ah, wage day! I mean, what’s not to love about it?

Payslips get sent out, bank accounts get a hearty refill, and we can all go out and put our hard-earned money to work - whether that’s making sure our bills are covered, saving up for a rainy day, or spending it.

However, do any of us really take the time to think about what’s printed on these documents?

We get it, they’re a tad confusing. Especially with all those funny-looking symbols and mysterious-looking deductions that can make you go, ‘I swear I never used to pay that much tax!’

Indeed, there’s an anatomy to what’s on a wage slip, and we’re going to use this post to break this down.

A payslip is much more than a salary receipt. It is a legally required itemised statement that breaks down the financial relationship between employee and employer for a specific pay period. Whether your organisation provides a physical paper copy or uses a secure online payslip system, the fundamental purpose remains the same: to provide transparency.

It details an employee’s gross income, that is, their pay before deductions, and itemises exactly what has been taken out in terms of tax, pensions, and other contributions, to arrive at the final net, take-home pay.

Beyond confirming that wages have been paid correctly, these documents also serve as vital proof of earnings. Individuals will frequently need to produce them to confirm income for such life milestones as applying for a mortgage, signing a tenancy agreement, or securing a loan.

Treating payslips with the same level of security as banking details is critical, because they contain a wealth of sensitive personal data. Beyond just seeing what you’ve been paid, safeguarding these documents is vital for three main reasons:

To prevent fraud: A payslip contains sensitive details like a home address and individual National Insurance number. If intercepted, this data provides everything needed for identity theft.

To maintain a financial history: Payslips are a record that allow you to easily check your tax contributions with HMRC, and confirm your employment tenure.

To prove income: These documents are essential as evidence of earnings for mortgage applications, tenancy agreements, loans, and so on.

Right, so let’s clear up some of this confusion, shall we? Every pay cycle, your payslip contains these five key details:

Your gross pay: This is the pay amount before any net deductions, but after any salary sacrifice.

Your net pay: In other words, this is the amount of money you’ll get once all deductions have been subtracted. This is what’s known as your take-home pay.

Deductions: You should also see the total amount of deductions taken. Remember, these may vary from period to period. That’s why they are known as variable deductions and include items such as tax, National Insurance and pension contributions. Within deductions, there may also be a section titled fixed deductions. These don’t ever change from month to month, for example, trade union fees. However, they do not have to be shown separately on your payslip if your employer provides a separate statement with these deductions once a year.

Payment method: Put simply, how the money is being paid. There are several ways an organisation can pay their workforce, from good old-fashioned cash or cheques to more modern-day bank transfers.

Hours worked: If you’re paid hourly, your payslip must also show how many hours you’ve worked to earn the sum stated on the payslip. However, if you are on an annual salary, you will not see this on your payslip, except when you work overtime.

If you’re an employer, then you can use a couple of tools to make employee payments easier, like Telleroo and FasterPayments.

In addition to the above, here are a few payslip abbreviations you’d usually find on a UK payslip and what they mean:

BACS - Bankers Automated Clearing Services - A scheme for processing financial transactions

CHB - Child Benefit - An allowance for parents with children under 16

ET - Earnings Threshold - The amount you get before paying any tax

PILON - Payment in Lieu of Notice - Compensation payment for a notice period to do with termination or a request not to work

LEL - Lower Earnings Limit - The amount you get before paying National Insurance

In addition to the core facts above, you might find a few other things listed on your payslips. Some of these things your employer may display, others they may not. Every company is different, but we’ve tried to break down as many of these elements as we can here below:

| Detail | Description |

|---|---|

| Personal information | Typically displays your full name and home address. |

| Payroll number | May include a payroll number for internal identification. |

| Payment date | Shows the date funds are due in your account. |

| Tax information | Includes your tax period, individual tax code, and National Insurance (NI) number. |

| Student loan repayments | Shows deductions for student loan repayments calculated by HMRC. |

| Child maintenance | Child Maintenance Service (CMS) requests for Deduction from Earnings Orders (DEO). Employers may charge a £1 admin fee per deduction. |

| Court orders | Direct deductions for unpaid fines or debts via court orders. Subject to a £1 administration fee. |

| Sick pay | Includes Statutory Sick Pay (SSP) for 4+ consecutive days off, plus any contractual occupational sick pay. |

| Maternity, paternity and adoption pay | Includes Statutory Maternity Pay (SMP) and potentially separate maternity pay. Paternity pay appears similarly. |

| Expenses and benefits | Lists taxable benefits like health insurance or meal vouchers and schemes such as cycle to work or season ticket loans. |

| Year-to-date information | Summarizes total income, tax, National Insurance (NICs), student loans, and pension contributions paid to date. |

Payslips contain a lot of sensitive and private data, which is why it’s essential to keep yours in a safe place. Wherever you store them should be secure and easy to access.

One of the safest things to do is to store your payslip online behind a secure password-protected portal provided by your employer.

For companies, we recommend using good-quality payroll software that offers employees their own separate, unique login. Furthermore, it’s important that staff can access this portal through their own private address rather than just your company email address. That way, if you ever leave that employer, you’ll still have access to your payslips.

Now, here’s the big question…how much of it do you really understand?

Because, while most of us think we’re confident when it comes to understanding our pay, a Department for Business poll found that 62% of workers don’t actually understand their payslips.

And that’s ok. In truth, most payslips are pretty poorly designed. So it’s no surprise most people feel like they need a course in ancient Egyptian hieroglyphics to read one.

We briefly touched on the importance of having a well-designed payslip template so employees can understand their pay better, and employers have fewer questions to field!

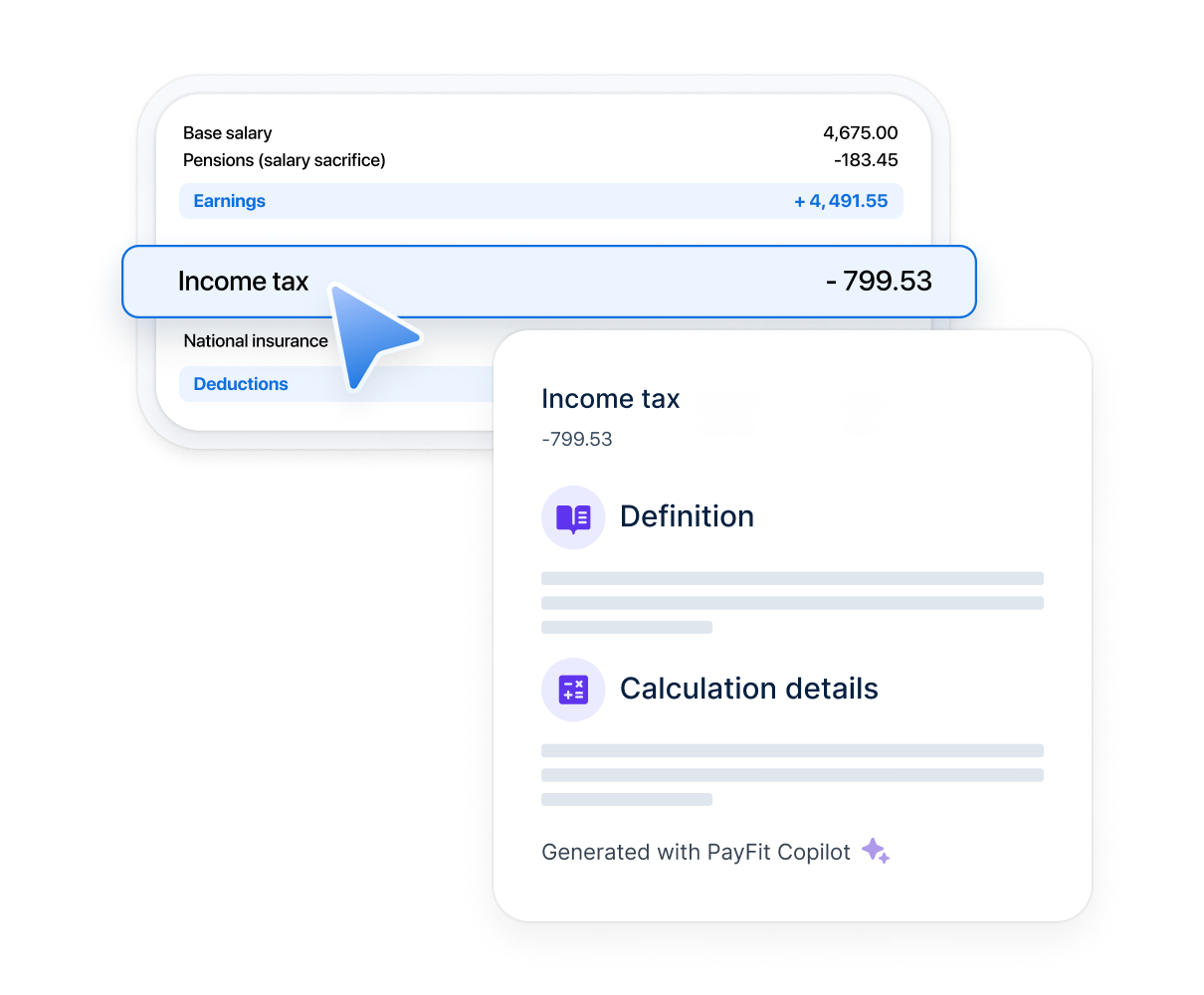

In designing our payslip, we looked to address the pain points shared by both employers and employees.

Our new payslip features more clarity of information displayed on basic payroll items, as well as increased transparency between company and employee.

Furthermore, we’ve gone one step further to actually break down calculations made for tax and provide additional insight, such as an annual leave summary.

It doesn’t hurt as well to produce a payslip that can reflect your employer branding (which PayFit’s white-labelled payslip template can do).

Are you an employer? Appreciate the look of our payslip? Want to experience more joy and less pain around running payroll for your company?

If you’re an employer or work in HR or Finance, then you know how time-consuming, stressful and repetitive managing payroll can be. Payroll software is one way to completely transform your payroll process, while producing better-looking, more transparent payslips for your employees.

As explored in this article, a better payslip can improve employee experience while reducing employee enquiries about pay.

On top of this, employees have lifetime access to their own individual portal where they can download payslips using their personal email address along with other important documents like P60s, P45s, and P11ds.

If you want to find out more about how payroll software like PayFit can improve your processes, you can book your tailored demo with one of our friendly product specialists today.

Ensure a smooth payroll process

In short, yes. In fact, it’s the law: according to the Employment Rights Act of 1996, employers must give each of their employees and workers a payslip for every pay cycle. The exceptions are if you’re a contractor or freelancer, a member of the police, merchant navy or a master or crew working member in share fishing.

If an employee has not received their payslip for a certain pay cycle, they’ll want to bring this up with their manager or HR team as soon as possible. If they don’t resolve this, the employee is within their rights to raise a formal complaint. Therefore, your staff must get their payslips on time, every time. Late payslips and delayed payments not only lead to complaints but can also lead to more severe compliance issues.

PayFact:

Did you know? One in five British workers has claimed to have left a job after being late or inaccurately paid by an employer. That’s equal to 7 million staff members across the UK workforce.

The UK tax year starts on 6 April every year. This is a crucial date to remember because it marks the point when your personal tax-free allowance resets, and it is also the date when any new tax rates or National Insurance band changes typically come into effect. This will naturally affect all of the calculations on your payslips for the tax year.

Tax codes are used by your company to calculate exactly how much tax to deduct from your pay. They usually consist of a combination of numbers and a letter. The numbers generally refer to the amount of tax-free income you can earn, while the letter relates to your specific situation (such as 'L' for standard tax-free allowance).

It is vitally important to check your statement regularly to ensure you have been paid the correct amount and that your tax contributions are accurate. Mistakes can happen, such as incorrect tax codes or missed overtime hours, so reviewing your slip each month helps you spot and resolve errors quickly.

Learn how to create a payslip that is HMRC compliant. This guide for 2026 covers UK law, deductions, software benefits, and the risks of manual templates.

PayFit unveils interactive payslip solution: 500+ payroll line variations explained with AI. Help employees understand their pay, case by case.

Discover the benefits of online payslips and how this simple example of workplace tech empowers staff with paperless, email-free workflows.

Everybody loves payday. Seeing your bank balance topped up and knowing that there's money to burn. It's a good feeling, right? But what about the payslip itself? Could that offer more? Well, we at PayFit think it can!

See what's new in PayFit

New features to save you time and give you back control. Watch now to see what's possible