Should Employers Offer a Holiday Purchase Scheme, And What Are The Benefits?

A holiday purchase scheme is an arrangement where employees can buy or sell a number of days from their holiday entitlement.

While some companies have introduced unlimited time off in a bid to minimise burnout, others have turned to this type of offering where employees sacrifice some of their salary in return for extra time off. The COVID-19 pandemic has made a lot of employers aware of the importance of prioritising physical and mental health. A holiday buyback scheme is one low-cost way that employers can allow their staff to 'buy' extra days of days of (unpaid) leave they can then use for additional rest and recovery.

Let's talk through how a holiday buy back scheme works for businesses as well as answer some of the most common questions around it.

What is a holiday purchase scheme?

Also known as a holiday buy back scheme, salary sacrifice holiday purchase scheme or even a holiday trading scheme, it’s an arrangement that allows employees to buy and trade extra days of unpaid annual leave. This could even involve the option of selling unwanted holiday back to the business, which could then be picked up by somebody else who needs it (as standard paid leave), an annual leave stock exchange of sorts.

If an employee chooses to buy extra holiday days, their salary is reduced by the number of days that they have taken in a particular pay period. On the flipside, should you decide to offer a holiday sell back arrangement, then you could pay back the staff member the number of days they choose to sell back to you once they have been taken on by another employee.

The aims of a holiday buy back scheme policy are to:

give staff greater control and flexibility over how much annual leave they can take each year;

improve the work / life balance, productivity and wellbeing of your staff;

ensure that staff take less sick leave as a result.

UK holiday purchase schemes are deemed to be a salary sacrifice arrangement as a portion of gross monthly salary is sacrificed in exchange for a non-cash benefit, in this case leave. You can cap the amount of annual leave staff can buy or sell, ensuring certainty and control for your HR department.

Who should be eligible for a holiday buy back scheme?

Employees should be made aware that requests to buy annual leave are not guaranteed, with all requests needing to be reviewed by a manager or member of HR. Typically, employees still in their probationary period should be excluded from any holiday purchase scheme policy.

Employers should also make note that any holiday purchase that takes an employee’s pay below the National Minimum Wage would be against the law, so those at or close to this figure will need their buy back allowance capped at the appropriate number of days.

Conversely, for any employee selling unwanted holiday back to the company (should you introduce a sell back scheme), you’ll need to ensure that this does not take them below their statutory minimum holiday entitlement, which is also enshrined in employment law (days the employee works in a week x 5.6).

Calculating an employee’s day rate

In order to work out how much to take out of an employee’s pay when they take unpaid holiday, you’ll need to calculate what they earn in a day, and multiply this by the number of unpaid days they have taken. The calculation is as follows:

The number of days they work per week x 52 weeks per year = x number of working days in the year

So for a full-time employee working a 5 day week, this will be 260 working days a year. And then, to work out their day rate, you simply do the following:

Employee’s annual salary ÷ number of working days in the year

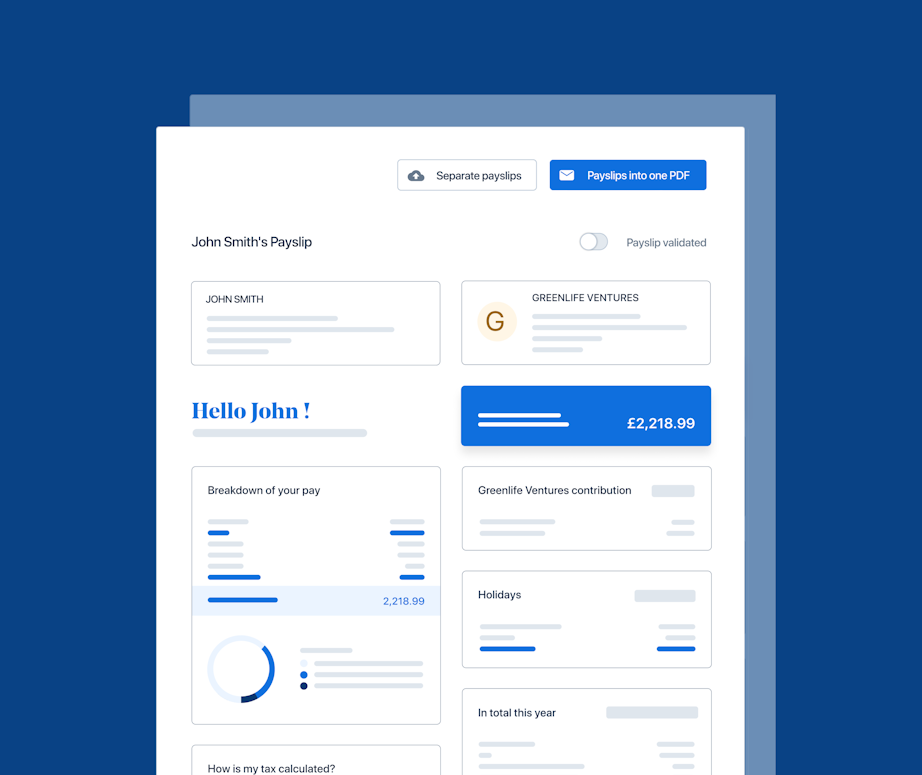

Reassuringly, when a member of staff using PayFit selects ‘Unpaid leave’ and has this confirmed by their manager, this automatically reflects on their next payslip - so no manual calculations required!

Read our complete guide to holiday pay here.

What are the benefits of a salary sacrifice holiday purchase scheme?

A well-administered holiday purchase scheme brings a whole host of benefits for both employers and employees.

For employers

An employer who advertises an option to buy additional annual leave on job ads will instantly catch the eye of searching talent. This is because whilst it is something that many companies do offer, very few actually advertise this on their job listings.

A holiday purchase scheme is a way of showing to prospects that you’re serious about values and culture, and taking care of your employees, making it a great way to attract top talent.

By the same measure, you’ll do better holding onto your existing staff by offering a buy back scheme, as it will provide breathing space for employees to prioritise their health and wellbeing a little better. As a result they’re likely to be healthier, happier and more productive. They’re also less likely to take sick days, so absences can be better planned for by managers and teams, in the same way that regular annual leave is.

And then - one that will make your finance team smile - there is the cost savings aspect of a holiday buy back scheme. If staff are sacrificing a portion of their monthly gross pay, not only do you save directly on this, but you’ll also pay less Income Tax and NI under a holiday pay scheme to HMRC.

For employees

Flexibility, improved wellbeing and being made to feel valued are core advantages for staff benefiting from a holiday purchase scheme. Burnout amongst UK workers is real - with a 48% increase across 2021 and 2022. Feeling that they are able to buy back a little extra leave will help to alleviate this, and encourage them to take regular time off throughout the year (rather than taking large chunks in one go as part of regular annual leave).

How PayFit helps employers manage unpaid leave

As alluded to already, PayFit’s intuitive payroll software makes it easy for managers and HR teams to offer and manage a holiday purchase scheme in the UK.

Employees are given a personal login, where they can view payslips and request leave. When requesting leave, they simply choose ‘Unpaid leave’ from the dropdown menu. Once this is approved, it will instantly reflect in their upcoming payroll and on their payslip, meaning not only will you not need to do any calculations or run payroll any differently, but both you and the employee will be able to see exactly what has been deducted from their pay.

All you need to do is to agree with employees how much unpaid leave they can purchase, and approve or reject requests as and when they come in - easy!

To hear more about how PayFit facilitates a smoother payroll and leave experience for both employers and employees, speak to one of our product specialists using the link below.

How To Work Out Hourly Rates In The UK - An Employers' Guide

Recruitment Process Guide - Stages, Selection, Automation

Employee Contracts - A Guide For UK Businesses

Part Time Workers' Holiday Entitlement - Guide & Calculator