✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

The challenges facing businesses in 2023 have been well documented already. From the high cost of borrowing and consumer belt tightening through to team morale and productivity issues, finance leaders face rough weather on numerous fronts. They’re looking not only to cut costs, but to create a department that’s resilient enough to weather future storms. Those issues aside, one major blocker is preventing this from happening.

And that is status quo bias.

Loosely defined as a preference for keeping things the way they currently are, the way they always have been, status quo bias is the business equivalent of Einstein’s definition of insanity. In other words, doing the same thing over and over and expecting different results.

But the status quo is a powerful thing. It’s comfortable, something to fall back on in uncertain times. But it’s also a barrier to positive change - and more of the same from the finance team can mean poor decisions being made for the business that can directly impact upon its success, or lack of.

In this post we’ll explain why status quo bias, for instance falling back on outdated or legacy finance systems, is a dangerous thing for any finance department. We’ll cover why making a few smart moves now can greatly benefit both the team and the wider business, and help to pay dividends over the long run.

Status quo bias is a cognitive bias, meaning it’s an irrational act based on beliefs and experiences. It describes our irrational preference for a default option simply because it preserves the current state of affairs. The phrase ‘if it ain’t broke, don’t fix it’ very much reflects the status quo bias mentality. This might often be ‘just fine’, but in an increasingly competitive business landscape, ‘just fine’ just doesn’t cut it anymore.

Status quo bias arises from the difficulty of making decisions, and it is hardwired into all human brains. We resort to the status quo in order to reduce complexity. When we have to choose between something we are familiar with and a new, uncertain alternative, we feel more comfortable going with what we know.

Apply this to a fast moving, sometimes chaotic finance team, where business-critical decisions need to be made on a daily basis, where it’s often a case of just trying to keep the ship on an even keel, and you can quickly see how status quo bias arises.

The concept of the status quo in business tends to be an alien one to CEOs and business owners, who are often looking to innovate and grow. But the very nature of the finance department can be both hectic and process-driven. Paying suppliers and staff, creating budgets, providing reports to investors etc. means that tried and tested methods are usually resorted to in order to keep things as stable as possible.

This would have been fine in the past, but as the finance function continues to evolve from a process-driven department to being a more strategic business partner, it just doesn’t cut it anymore. Coupled with an increasingly competitive landscape, the need for innovative, long-term thinking is more important than ever in order to get ahead of the competition.

Trying new and unproven tactics may go against our basic instincts, but in a finance department the status quo may well be less efficient, more expensive and more time consuming than an innovative alternative.

Indeed, outsourced payroll costs a business more than just money. The traditional way of paying staff, it is however one that presents increasing risks and disadvantages for both finance teams and the wider business. These include:

the risk of employees being paid late or incorrectly, and them leaving as a result (something that payroll automation helps to resolve);

a lack of control over or insight into company financial data, a common complaint with payroll outsourcing;

the outsourced provider not providing the level of urgency, care and attention that your business requires;

data security breaches. When sensitive employee data is handed off to a third party, there’s an increased risk of a breach. In-house payroll software, PayFit included, maintains very high security standards (we’re ISO certified).

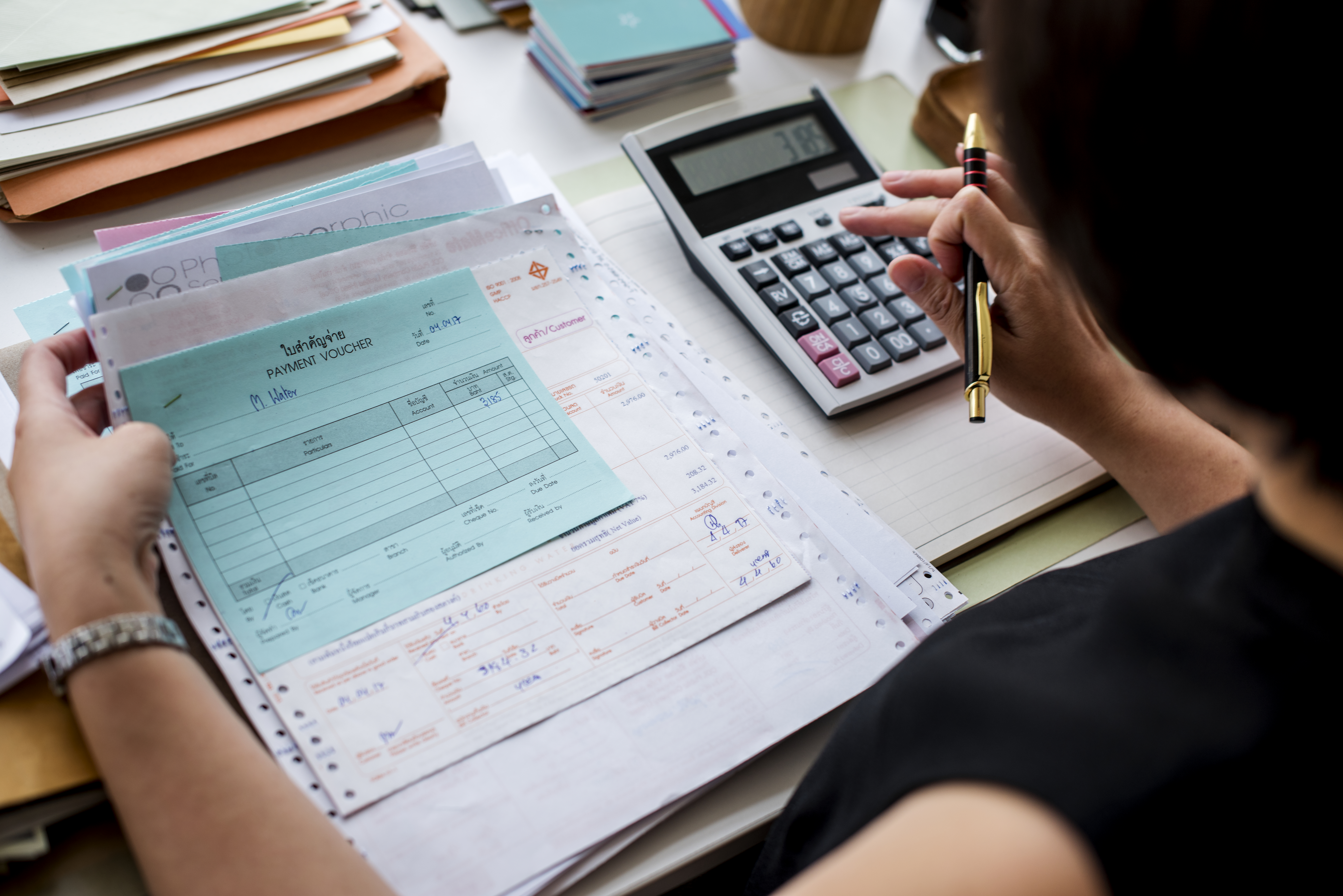

Other legacy finance systems such as those administering accounts payable / receivable, contracts and cash management typically involved paper and spreadsheets. Status quo bias dictates that those inefficient, error-prone, time consuming (yet familiar) methods are continued with (when a degree of finance automation may be preferable).

However, all this does is get finance teams bogged down in repetitive tasks, leading to burnout and a lack of time for business-impactful initiatives that can help you gain a competitive advantage.

In summary, status quo bias can lead to lazy decision-making, because we don’t consider all the options that are available. As a result, decisions are based on ease rather than sound reasoning. And because of this, we end up making suboptimal choices that are not in the best interests of the wider company.

Norman Chevrette, President & CEO at CME Corp, was kind enough to give us his take.

After navigating the difficult waters of redundancies earlier in 2023, finance teams are increasingly looking to strengthen their foundations with smart software investments that can help improve workflows to improve productivity, reduce burnout and protect the business against future shocks. By rebuilding legacy processes and systems, businesses hope to both gain competitive advantage as well as be prepared to come out the other side stronger in future.

Rather than replacing the work of humans, software can help us do our jobs that little bit better. Indeed, by reducing the human input just that little bit, the potential for status quo bias is reduced. Software helps us to analyse all available data and options quicker, leaving more time and potential for making a sounder, more rational decision.

It lends weight to the argument that the future of finance is digital, one with more insightful and transparent data at your fingertips, with more efficient processes that reduce the risk of human error and allow finance teams the time and mental space to make sound business decisions.

Find the right payroll software

The true cost of employee turnover can be hard to define. We take a deep dive into the most costly expenses associated with employee turnover.

Understand accounting for a growing business in the UK, including best practices, the right set-up for your company, and key tax considerations.

PayFit's helps drive radical finance process improvement for small to mid sized businesses up and down the country. Read this piece to find out how.

Read our take on the three business cases that make building the perfect tech stack for your finance team priceless.

Learn all about finance digital transformation and how to shift gears within your finance function from cost-cutting to growth-driving.

Automation in finance is a hot topic. In this piece, we run through 7 workflows that finance teams should be automating to improve efficiency.

See what's new in PayFit

New features to save you time and give you back control. Watch now to see what's possible