The key features of PayFit’s Premium plan, and the benefits they can bring

Managing payroll in the UK can be time consuming and complex, especially for scaling teams that don’t yet have the knowledge or time to tackle trickier payroll and compliance situations. Many UK businesses want to just totally relinquish control and outsource everything to an accountant or payroll bureau. But as our recent UK-wide ‘outsourcing pains’ survey showed, businesses that do this tend to end up wishing they hadn’t.

But what if there was a ‘best of both worlds’ solution, one that combined in-house-owned payroll software that you own and control, together with dedicated round the clock support and monthly pre-payroll check-in calls?

Allow us to introduce to you PayFit’s Premium plan, the ultimate UK payroll package.

Offering a wealth of additional features and benefits above and beyond our Light and Standard packages, Premium comes loaded with a full suite of payroll management capabilities. Plus, there’s custom payroll journals, non-standard pension submissions, fully managed P11Ds and even the ability to correct or re-run payroll if you make a mistake.

And it does all this while providing a level of support you’d expect from a fully outsourced solution, but might not necessarily get.

Here’s a breakdown of what our Premium plan offers UK businesses on top of PayFit's other two packages.

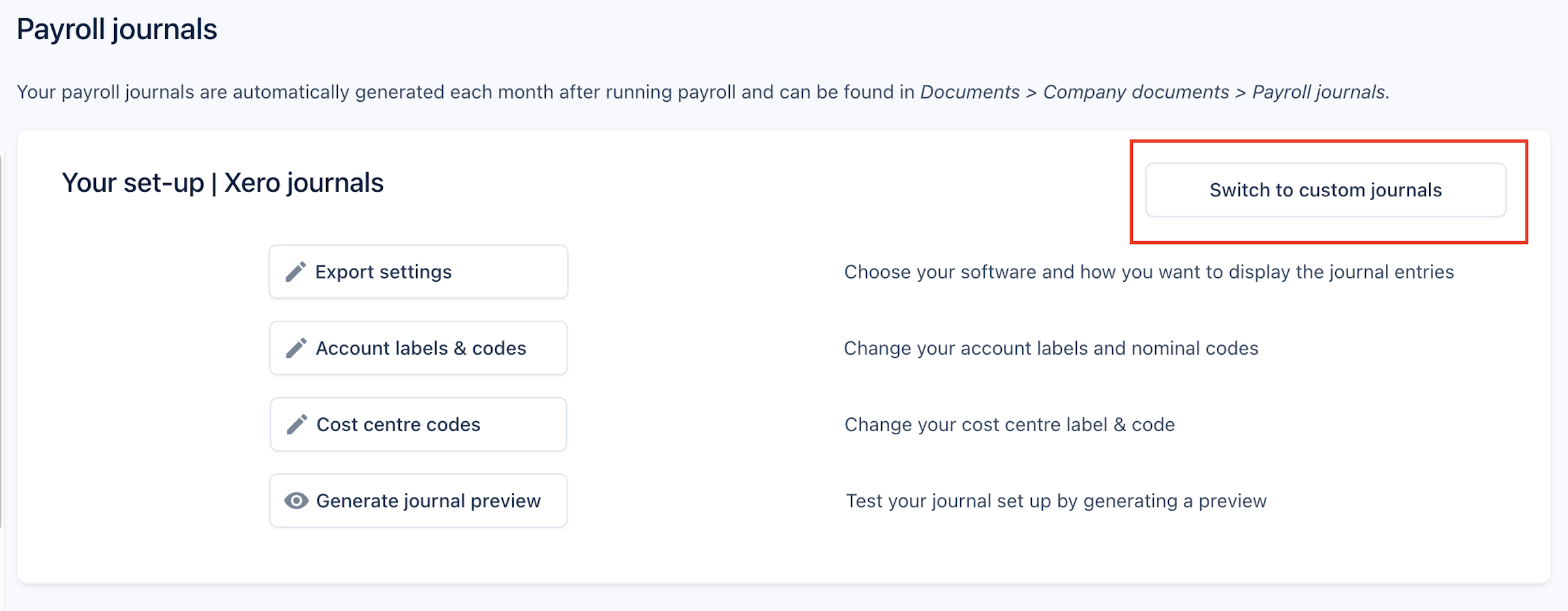

Custom payroll journals

One of the many reasons businesses choose to move to PayFit is the time taken up every month on payroll journals. Manually creating a journal yourself using an Excel spreadsheet and then transferring it into your accounting software comes with a host of issues. You’ve got the risk of errors and inaccuracies (that goes with any kind of manual data entry) not to mention the possibility that you’ll need to tinker with your journals so that they’re compatible with your accounting software, which needlessly adds more time to monthly payroll processes.

PayFit automates the creation of payroll journals in the correct format for the major accounting providers across all plans, however Premium takes it one step further.

With Premium, our team of CIPP-recognised UK payroll experts will help you to set up fully customised journals, complete with non-standard formatting for other accounting platforms. You’ll have the option to create unique line items based on your specific needs, too. For example, customisable cost centre codes mean you can attribute various payroll costs to the department in which the work was done.

How’s that for insight?!

Fully managed P11Ds

Creating P11Ds is time-consuming and worry-inducing and a spectre that looms large over UK payroll teams come deadline day in July.

P11D forms are generated automatically as part of our Standard plan, but you’ll still need to submit them to HMRC yourself, not to mention keep in contact over any follow-up actions or corrections. And, anyone who’s tried to get in touch with HMRC will know that this can be a little challenging at times.

PayFit Premium customers enjoy a truly end-to-end P11D experience. This includes the automated annual form generation but also submission to HMRC and, crucially, all further correspondence and actions with the organisation. So that means no more sitting for hours on the phone or the risk of making any amendments incorrectly. We really do take care of everything for you.

So that’s one major annual task you won’t need to worry about ever again.

Non-standard pension submissions

Nobody wants to get bogged down with manual calculations and file manipulations when it comes to pension scheme submissions. It takes you away from what’s really important and impactful for your company - HR initiatives such as planning new training initiatives, employee engagement drives, or recruitment planning. That’s why PayFit automatically generates files for all main UK workplace pension providers.

Premium customers get auto-generated pension files too, but also for lesser known providers that don’t integrate with PayFit. These, too, can be simply uploaded directly into your pension portal, with no manual calculations or file manipulation needed.

So no matter which workplace pension scheme you’re signed up to, you can rest assured that everything will slot into place nicely with Premium.

Payroll re-runs & corrections

We’ve got to admit that we’re pretty chuffed with this Premium feature. Painstakingly developed by our Product team, not only are Premium users able to correct and re-run payroll after the fact, but all corresponding data in the platform is automatically adjusted at the same time. So that means income tax due to HMRC, P11Ds, P60s, NICs, pension contributions, and more, are all recalculated and available to view in real time. Mistakes with running payroll happen, but with our Premium re-run payroll feature, you can, quite literally, turn back the clock.

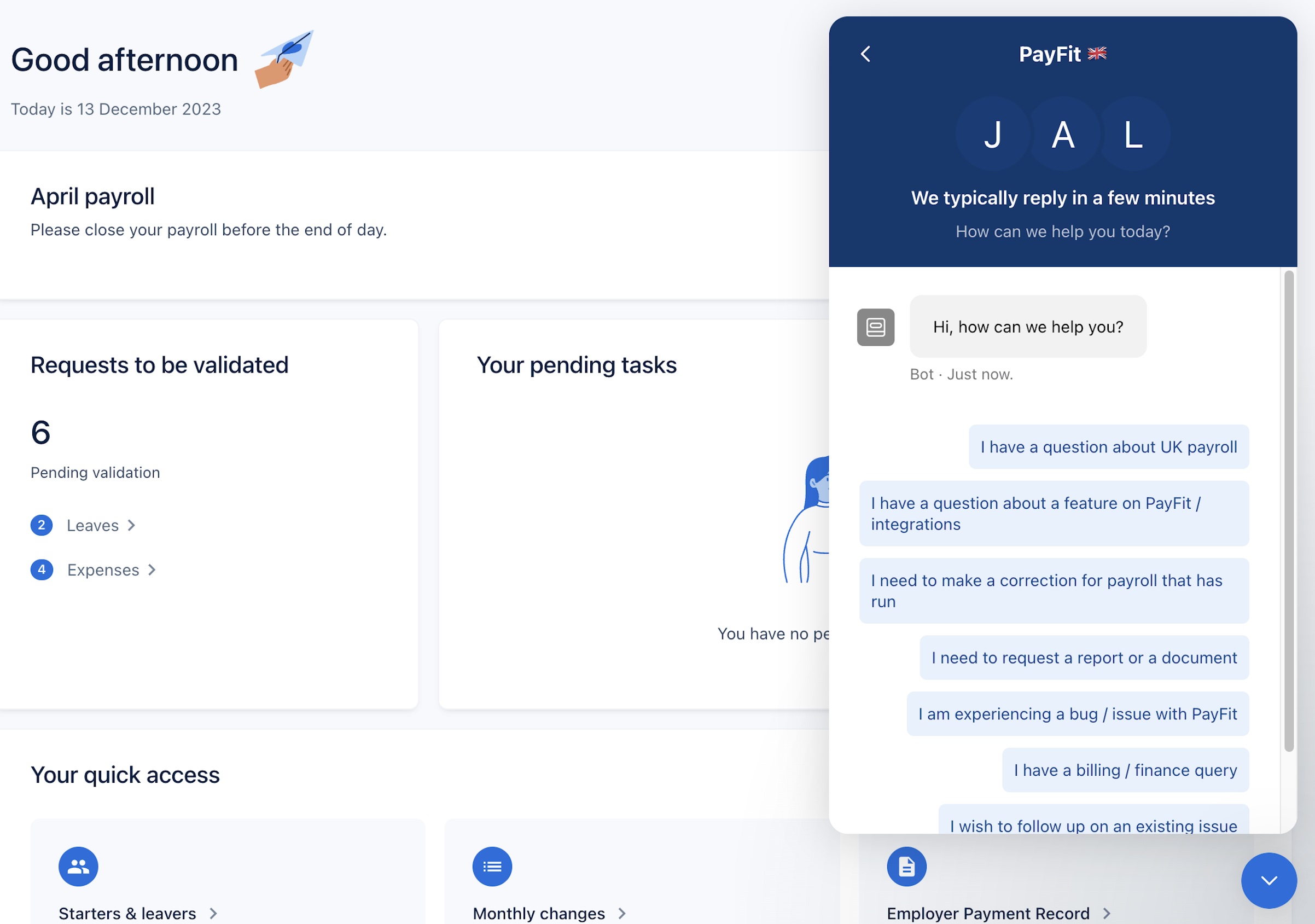

Live chat

A common complaint of outsourcing payroll is the time spent going back and forth over email with the service provider. You might get an ‘out of office’ notification, or have to wait several days for a response. And even then, it might not be what you were looking for.

Our Premium plan’s live chat feature helps you get the response you were looking for in minutes, with a huge range of different pre-populated responses geared towards the most common queries we receive. It effectively helps you to skip the ticketing system associated with our Standard plan, meaning no hold ups at crucial times of the month.

A dedicated personal account manager

One of the hesitations for UK businesses weighing up whether to bring their payroll in-house is the worry that they’ll simply be cast adrift, with a lack of support or helping hand in times of need.

But this couldn't be further from the truth.

Companies with over 25 employees can take advantage of the crème de la crème of our Premium support functionality. Your dedicated customer support representative will be on hand whenever you need them, with a regular mid-month pre-payroll call to analyse, check corrections and provide industry updates.

They’ll frequently analyse your processes and assess usage data to help you get the most out of PayFit. What’s more, you’ll have their mobile number and be able to book a meeting with them via an online link when it suits you. Quarterly business reviews give you the chance to raise any questions or concerns and get the insights needed to help you make better-informed decisions for your business.

It’s the best of both worlds - the control that comes with owning and managing your own payroll, with an easily accessible helping hand whenever you need it.

Callback service

We’ve spent years honing our support ticket system, but should you want to guarantee being at the front of the queue and get an answer to your pressing queries first, then only Premium’s callback service gives users this opportunity.

In the busy periods around month and tax year-end, the last thing you want is to be pulled away from your priorities for a call. So, Premium lets you choose a callback time that’s most convenient, helping you get all your ducks in a row at the critical moments in the payroll lifecycle.

Find out more about how our Premium plan makes managing payroll a breeze by getting in touch to book a demo with a member of the team.