The Alabaster Ruling & How it Relates to UK Maternity Leave - A Guide

If an employee receives a pay rise at any time between the start of the relevant period and the end of statutory maternity leave, then SMP must be recalculated for that individual, taking into account the pay rise. The legislation is otherwise known as backdated pay awards during SMP, or the Alabaster ruling, and was based on a European Court of Justice decision from 2004, which passed into UK legislation in April 2005.

In this guide, we’ll help employers to understand the time periods involved in Alabaster calculations, how to calculate the additional pay, and how PayFit can help make both Alabaster and SMP processes much smoother

What is the Alabaster ruling, and when does it apply?

The Alabaster ruling, also known as ‘backdated pay awards during SMP’, came about after a case between an employee of the same name, and Barclays Bank PLC. Ms Alabaster commenced maternity leave in January 1996, having been given a pay increase in December of the previous year. However, this was not included in her maternity pay calculation. Ms Alabaster was able to successfully argue that even though Barclays had paid her in accordance with the terms of SMP, this was in breach of the Equal Pay Act, and European law.

The European Court of Justice found that the SMP regulations, as they were at the time, failed to properly comply with EU law. Therefore in 2005, UK SMP regulations were amended, and the Alabaster rule passed into UK law.

It applies whenever a pay rise is processed at any time from the start of the relevant period and the end of statutory maternity leave. But how do you know when these are? Read on to find out.

The crucial time periods to be aware of for Alabaster calculations

Ensuring Alabaster payment compliance is all about knowing what various maternity pay-related terminology means, and when it refers to.

Some key phrases and time periods to be aware of:

Relevant period - the 8-week period before the qualifying week;

Qualifying week - 15 weeks before the expected week of confinement (EWC);

EWC - the Sunday on or before the baby’s due date.

This means that the start of the relevant period is at least 23 weeks before the EWC. It should also be noted that the end of statutory maternity leave is 52 weeks after maternity leave starts.

How to work out what additional pay is owed to the employee

Firstly, check the employee's relevant period. As explained above, this is the 8-week period that falls before the qualifying week. Gather the employee's payslips that fall in the relevant period.

Next, recalculate the employee's gross pay using the increased salary. To calculate the new average weekly earnings, multiply the number of payslips used to equal a full year's earnings. For example, if using two monthly payslips, multiply by 6 to get 12 months earnings.

Divide the value from the previous step by 52 weeks to determine the weekly pay.

Then, calculate 90% of this weekly pay, and work out the difference between the new weekly pay and the employee's original pay rate. This is because the employee receives 90% of their average weekly earnings for the first 6 weeks, then the following 33 weeks is calculated at the statutory rate, or 90% of their average weekly earnings, whichever is lower.

Multiply the difference calculated in the previous step by the number of weeks that were paid at the lower average weekly earnings.

Don't forget you only need to calculate the difference for weeks that have been paid. If the employee is still receiving SMP, the remaining weeks will be calculated at the correct rate.

You now have the difference to pay to the employee this month.

An example calculation

How PayFit helps make fiddly SMP and Alabaster calculations a breeze

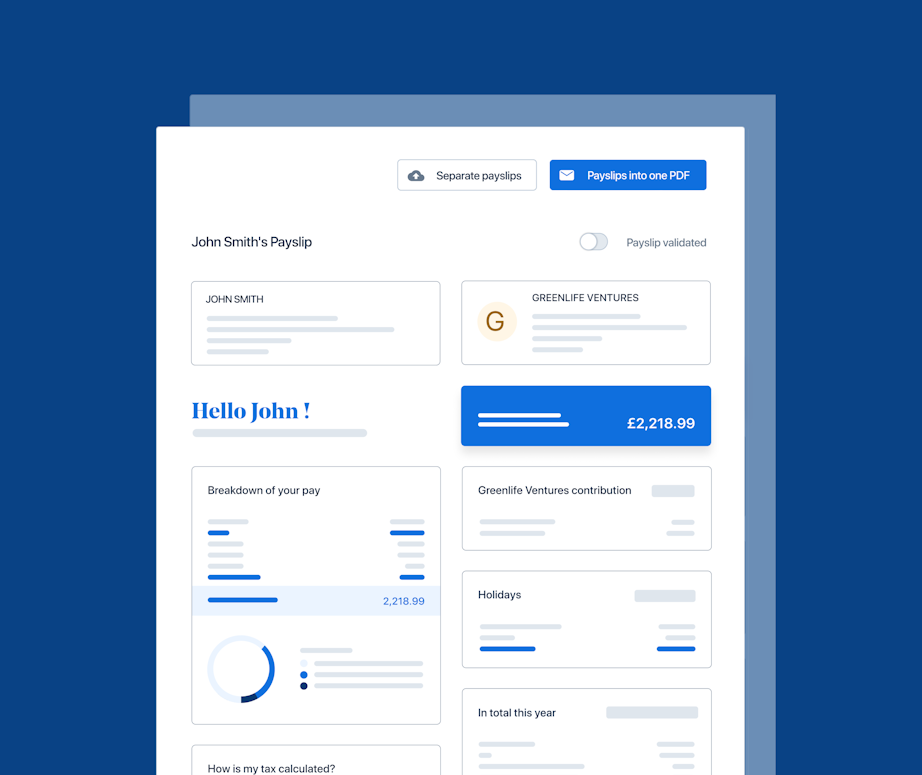

As part of automating all parental leave calculations, PayFit can be used to simplify Alabaster calculations too. Maternity pay settings can be customised to ensure that both the average monthly earnings during the relevant period can be specified manually, as well as the default SMP amount adjusted to reflect the Alabaster rule.

The remaining SMP due is re-calculated automatically, and as the value will have been entered in PayFit as SMP, you’ll be able to reclaim the additional amount from HMRC. And this will handily show on an Employer payment record within your reports dashboard, so you don’t forget to claim this back.

Better yet, any new rates, including SMP, are coded into PayFit before the start of every new tax year, so resulting calculations and payments will always be correct.

Find out more by arranging a short demo on the link below.

How To Work Out Hourly Rates In The UK - An Employers' Guide

Recruitment Process Guide - Stages, Selection, Automation

Employee Contracts - A Guide For UK Businesses

Part Time Workers' Holiday Entitlement - Guide & Calculator