HMRC New Starter Checklist Explained for Employers

The HM Revenue and Customs Starter Checklist, or HMRC starter checklist for short, is a form new employees without a P45 must complete.

Previously known as the P46, it’s one of the key employment forms for new employees which should be included as part of the onboarding phase. Ensuring the HMRC new starter form gets filled out means you can upload everything into your payroll system right from the start and tax new staff correctly from their first payday.

Let’s take a closer look at what the new employee starter form is within payroll and how to use one.

What is the HMRC starter form / checklist?

Simply put, the HM Revenue and Customs (HMRC) starter checklist collects vital information that HMRC needs in order to retrieve the correct tax code for your employee. This includes details of their previous income and any student loan repayments.

Is it the same as a P46 in the UK?

Yes, the HMRC starter checklist used to be known as the P46 or P46 starter checklist. While the purpose remains the same - to collect information when onboarding UK employees who don't have a P45 form - the name has been updated to reflect its role more clearly. You might also hear it be called the HMRC starter form’ or ‘new employee starter form or checklist.

Does an employee need one if they have a P45?

No, if the employee has their P45, you don’t need them to complete a new employee starter checklist at all. The P45 provides all the necessary information to continue taxing the employee correctly.

Where can I get an HM revenue starter checklist in the UK?

HMRC’s starter checklist is readily available online. Employers can download it directly as a printable PDF from HMRC’s website. This makes it accessible and easy to distribute to new hires who need it.

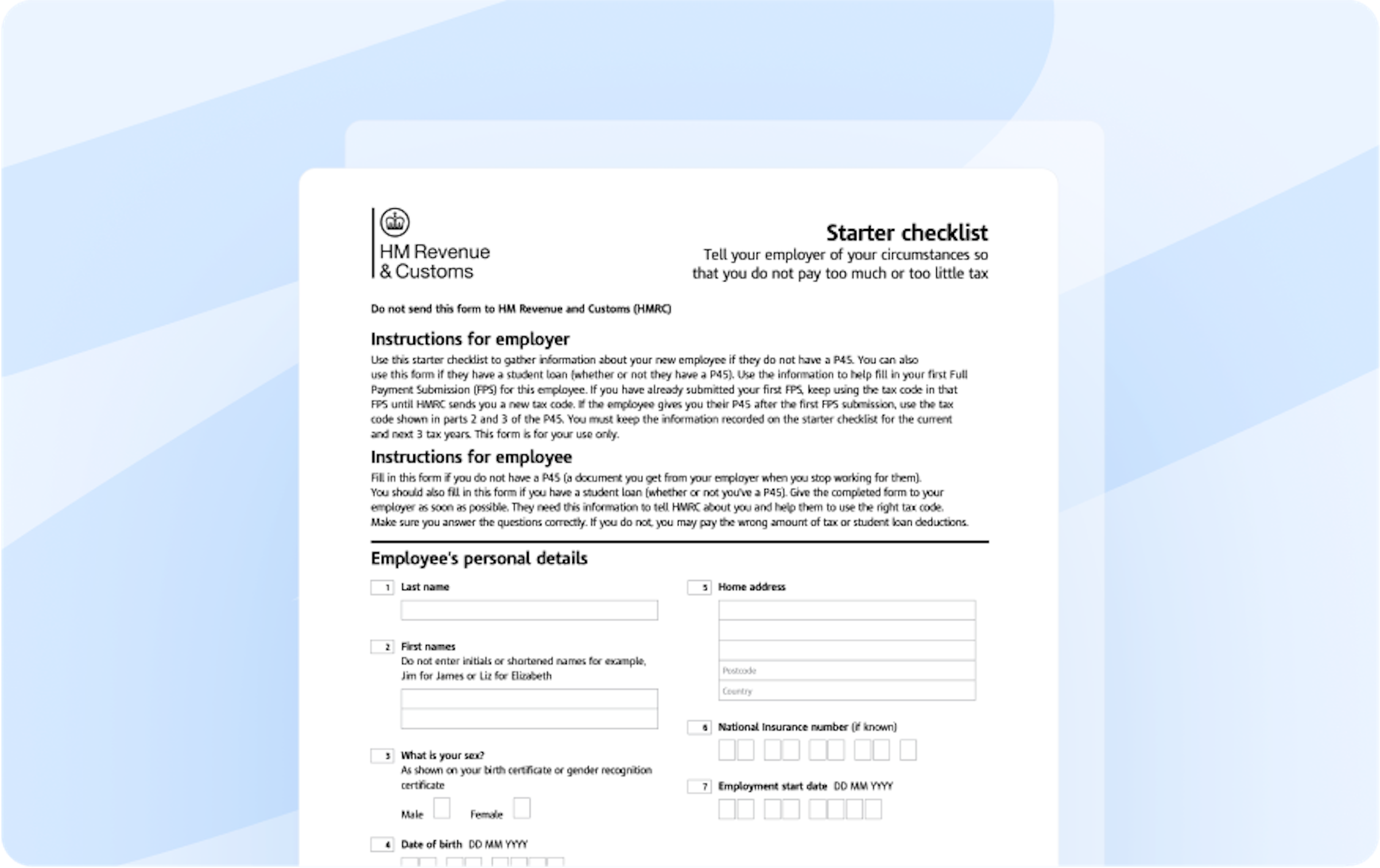

This is what it looks like...

How to fill out HMRC’s new starter form

Filling out the HM revenue and customs starter checklist is pretty straightforward. It will guide your employee through a series of questions about their previous employment and earnings within the current tax year. Ideally, employees should complete this as part of your onboarding process and will need the following information to hand:

✅ some personal details, like their name, full address and DOB

✅ their National Insurance number

✅ their start date at your company

✅ information of any student or postgraduate loans

✅ the last tax code they were on

✅ details of any income received in the current tax year from another job, as well as:

a pension or from Jobseeker’s Allowance

Employment and Support Allowance or

Incapacity Benefit

Sometimes, a company sends an employee overseas to work for a specific period of time. In this case, the worker must also fill out a new employee starter checklist and include their passport number on it.

It’s important for employees to answer all these questions accurately so they can be taxed correctly.

Helping employees pick the right statement

When they complete their HMRC new starter checklist, employees will have to choose between three separate statements: A, B or C. Which one they choose will depend on their personal situation:

HMRC new employee - Statement A

If this is the employee’s first job in the current tax year, they should choose this statement. They also shouldn’t be receiving taxable Job Seeker’s Allowance, Employment and Support Allowance, or any taxable incapacity Benefit or state or occupational pension.

HMRC new employee - Statement B

If this is the employee’s only new job, but they’ve had another job since the 6th of April, it’ll be this statement. If your new hire has also received taxable Jobseeker's Allowance, Employment and Support Allowance or taxable Incapacity Benefit since the 6th of April, this should be the box they tick.

HMRC new employee - Statement C

If the employee in question has another job or receives a state, works or private pension, then option C is for them.

What if I don't have a P45 or starter checklist?

If a new employee doesn’t have a P45 from their previous employer, the HMRC new starter checklist form is their next best option. Completing this form will allow you to process their payroll accurately. Without either document, you’ll need to use an emergency tax code, which could result in incorrect tax deductions.

A word on emergency tax codes 🆘

Without either a P45 or completed starter checklist, employers must use an emergency tax code, which could result in incorrect tax deductions from the employee's pay. For a deeper dive into emergency tax codes and their implications, check out HiBob's comprehensive guide on the HMRC new starter checklist, which covers some interesting edge cases that HR teams should be aware of.

When and how do I submit a starter checklist?

Interestingly, you don’t submit the starter checklist to HMRC. Instead, you use the information it contains to update your own payroll software (like PayFit!), which then communicates the relevant details to HMRC through Real Time Information (RTI) submissions. This process ensures HMRC has up-to-date information on all your employees' tax codes and statuses.

Ace it with PayFit! 🤝

Whenever you have a new starter, our software prompts you for the information required for the starter checklist. Your input is then automatically and securely shared online with HMRC during your next pay run via your Full Payment Submission (FPS).

Do foreign workers pay National Insurance in the UK?

Yes, foreign workers in the UK are subject to National Insurance contributions, just like UK residents. The information collected through the starter checklist helps determine their correct tax and National Insurance (NI) contribution levels, ensuring they’re treated fairly and in line with UK employment laws.

Streamline your onboarding process with PayFit

Whether you're dealing with the complexities of P11Ds or navigating PAYE, PayFit has the tools and insights you need to manage your payroll efficiently. Remember, while the HM Revenue Starter Checklist is a critical document for new starters without a P45, PayFit's software ensures that its integration into your payroll system is seamless and straightforward.

One less thing to check off

The HM Revenue and Customs starter checklist might seem like just another piece of paperwork, but it plays a crucial role in ensuring your employees are taxed correctly right from their start date. While filling one out is pretty straightforward, it’s important that employees pick the right statement to fill out on it.

The starter form can also help you determine the right amount of tax and NI to pay for foreign workers. By understanding how to obtain, fill out, and use this checklist, you can streamline your onboarding process, ensuring compliance and accuracy in payroll and all associated reporting.

The HMRC starter checklist should be completed when a new employee doesn't have a P45 from their previous employer. It's a crucial part of the onboarding process that helps determine the correct tax code for new starters. The form should be filled out before or on their first payday to ensure accurate tax deductions. Learn more about tax codes and what they mean for your employees.

Without either a P45 or completed starter checklist, employers must use an emergency tax code, which could result in incorrect tax deductions from the employee's pay. This might lead to over or underpayment of tax, requiring adjustments later. Find out more about running payroll correctly for your new employees.

Employers don't submit the actual starter checklist to HMRC. Instead, they input the information into their payroll software, which then communicates with HMRC through Real Time Information (RTI) submissions. Understanding how PAYE works for employers is crucial for this process.

The statements help determine an employee's tax status based on their current situation. Statement A is for first jobs in the tax year, B is for those who've had another job since 6th April, and C is for employees with multiple jobs or pensions. Understanding these distinctions helps ensure accurate employment tax calculations.

Yes, foreign workers should complete the starter checklist just like UK residents. They'll need to provide additional information, including their passport number if they're working overseas. The form helps determine their correct tax and National Insurance contributions. Learn more about submitting employee details to HMRC for foreign workers.

P11D Forms Explained: A Guide For UK Employers In 2025

How Much Does an Employee Cost UK Employers in 2025?

Bank Holidays UK: Employment Law Guide 2025

UK Statutory Notice Periods - An Explainer For Businesses

What Is OTE? How UK Businesses Can Unlock Its Potential