✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

✨ Health insurance, now in PayFit - learn more

💷 All the rates & thresholds you need to know for 25/26...right here

✨ The Payroll Journey: Start, Scale & Succeed Globally - learn more

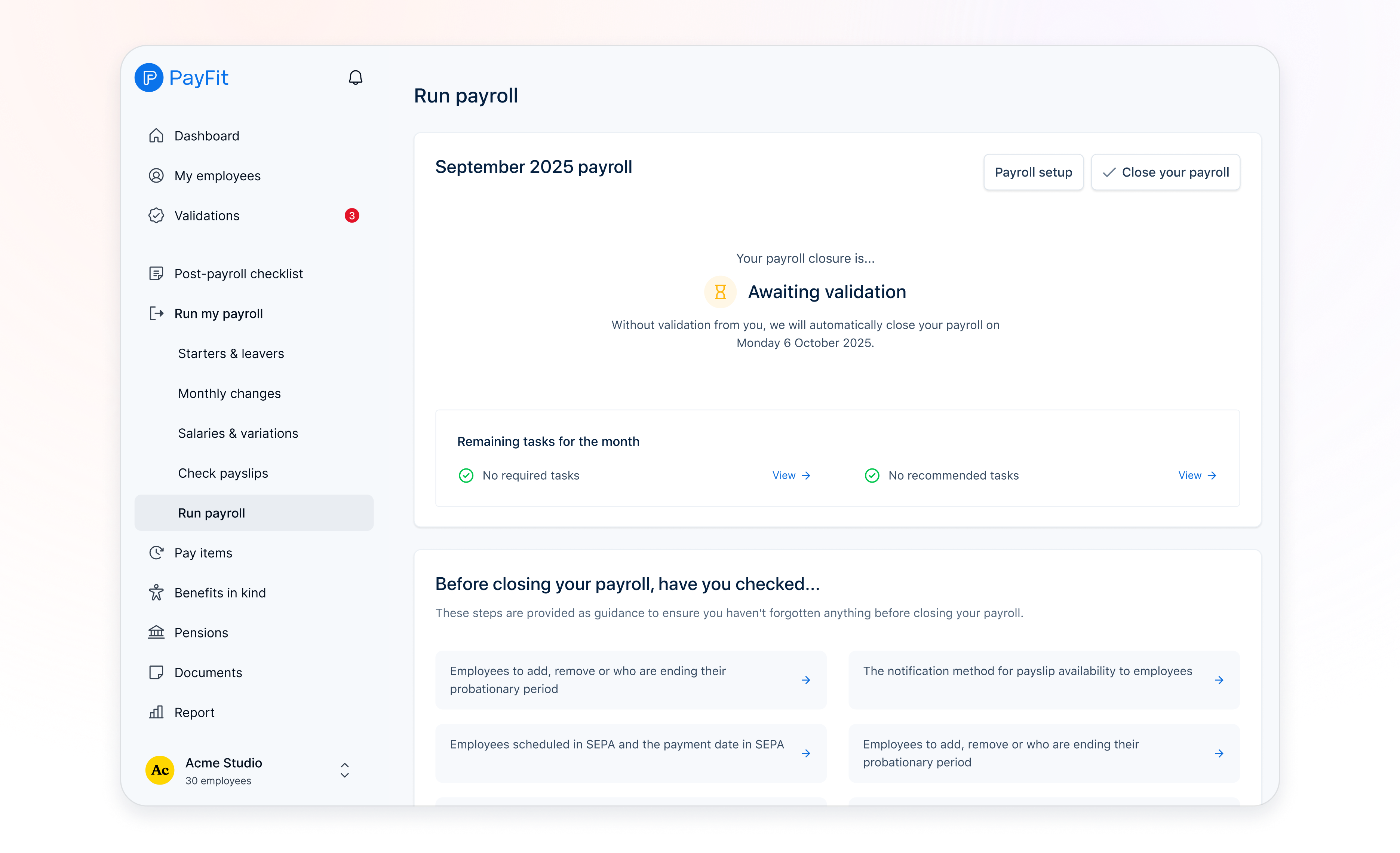

Give inefficiencies the boot, choose payroll software that even novices can use

90%

time saved each month

1 hour

to run payroll for a 30-person company

24/7

expert support

Error-free payroll, automated RTI submissions, next-level reporting: with our payroll software solution, everything is finally under control.

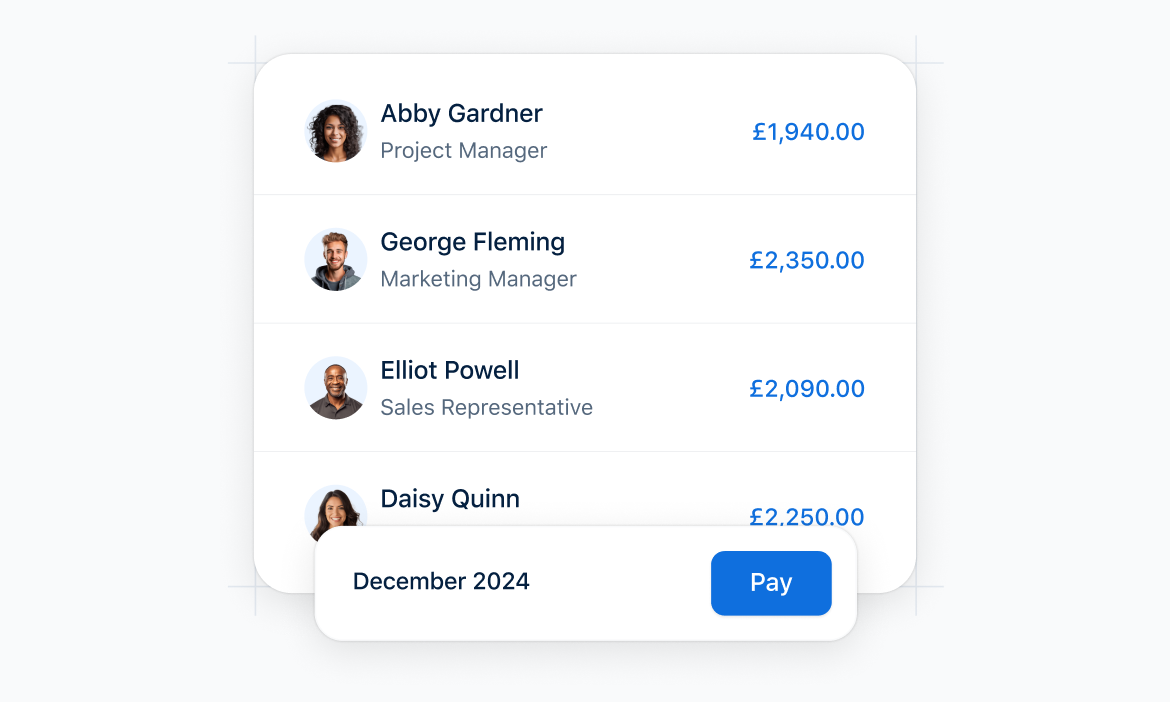

Your people get paid on time, every time, without errors. Even if you’re a payroll novice!

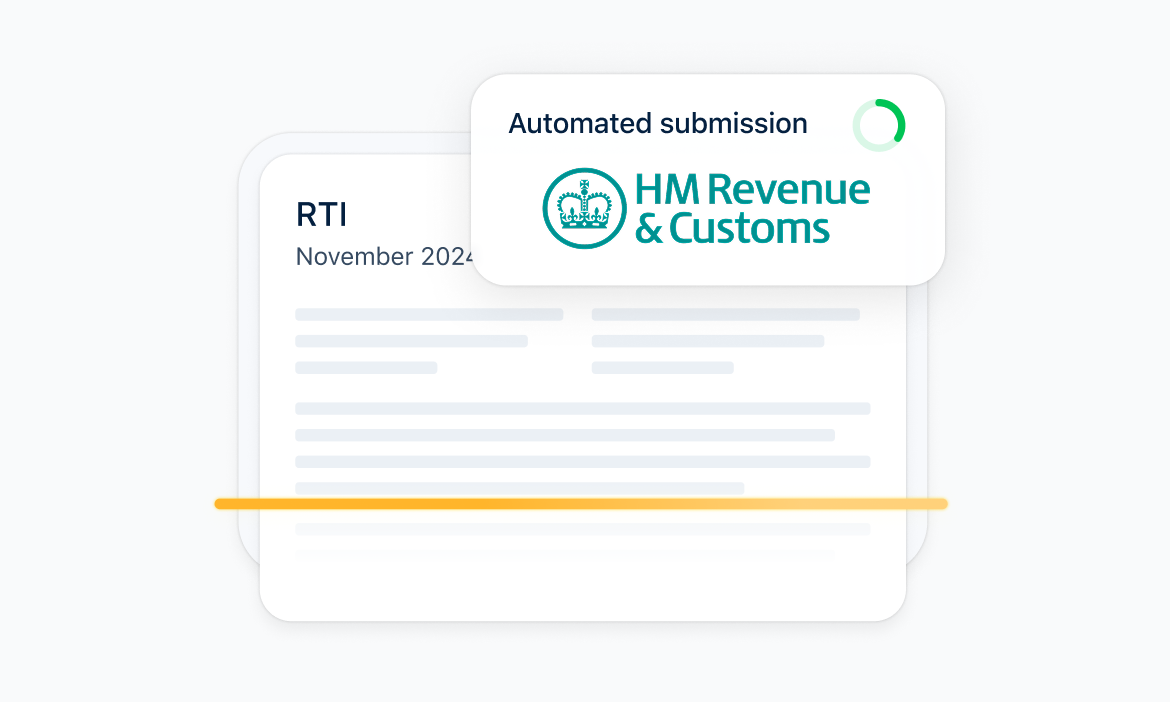

We take care of your HMRC and pension submissions so you don’t have to, and then let you know what needs to be paid.

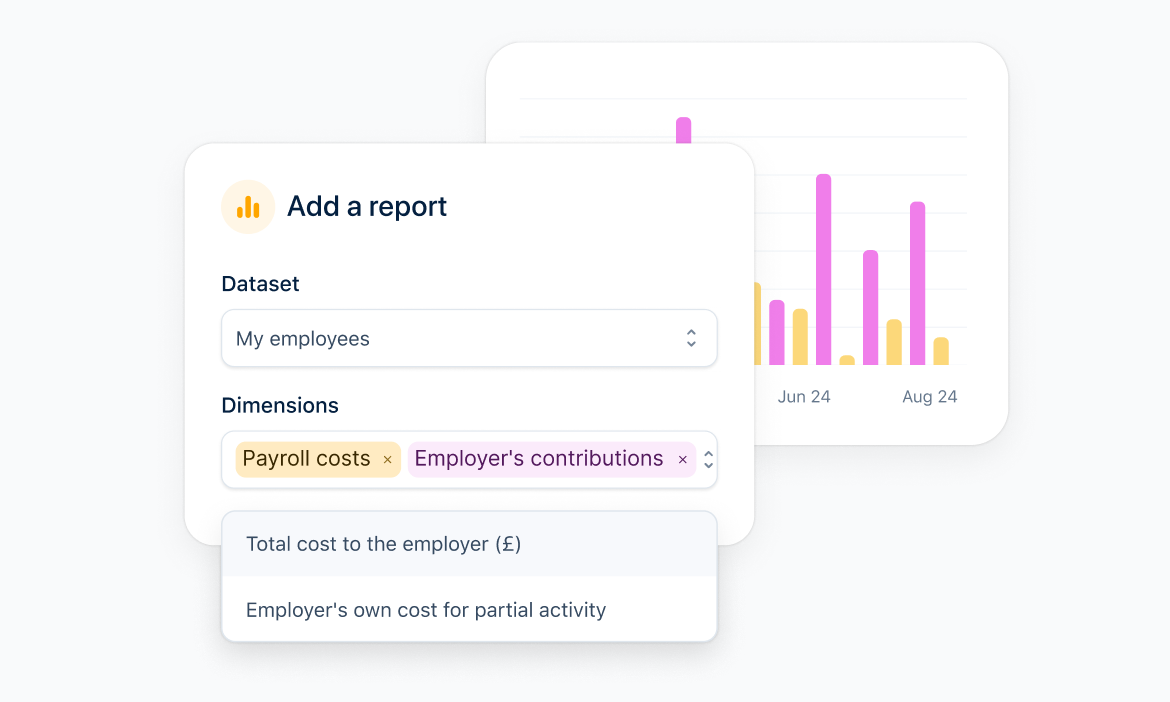

Our online payroll tool acts as a single source of truth for all your data, with reports tailored for HR and Finance teams.

Add and edit variables such as bonuses or commission right up until payday, with changes reflecting on payslips in real time. No more spreadsheets or multiple entries.

View the impact of your updates live and maintain full control over your employees’ payslips.

Pay your people instantly, and in bulk, with Telleroo faster payments, an integration reserved only for the best UK payroll software.

Your RTI (real time information) submissions are automatically sent to HMRC - ditto for your pension submissions.

Payslips are automatically sent and centrally stored, completely securely. Ours are some of the simplest to read in UK payroll.

From Capterra

Smoother payroll

in RDT's post-accountant world

Happier staff

Greater accuracy, better information

Payroll software for small UK businesses

The best payroll software should be HMRC recognised, offer automated calculations, real-time RTI submissions, and dedicated support. We provide all of these plus automatic updates whenever new rates come into legislation, making it ideal software for payroll for small businesses.

Our HMRC-recognised payroll software automatically handles all statutory calculations, RTI submissions, and regulatory updates. Our system ensures your business stays compliant with the latest legislation while reducing manual input and potential errors.

Modern payroll systems like ours are designed to manage various pay frequencies, multiple departments, and complex calculations. Our software automatically processes everything from basic salary to bonuses, while keeping accurate records for HMRC compliance.

We combine powerful automation with flexibility and support. Unlike other payroll systems, we offer last-minute changes right up to payday, an undo feature for corrections, and expert CIPP-qualified support. Plus, our software integrates seamlessly with popular accounting and pensions software.

You can cancel anytime

New features to save you time and give you back control. Watch now to see what's possible