What is the Difference Between Disallowable and Allowable Expenses?

Every UK business incurs certain expenses to keep the lights on and ensure operations run smoothly.

It can sometimes be challenging to manage these expenses considering how they can be for different things. It gets even more confusing when you discover that you’re expected to pay corporation tax on some expenses (allowable expenses) and not others (disallowable expenses).

How do you tell the difference? We’ve written this guide to help you.

After reading, you should know what allowable and disallowable expenses are, the differences between these expenses, and typical examples of both types.

What does “allowable expenses” mean?

“Allowable expenses” is a term used to describe costs or expenses you incur while running your business that you can claim as tax deductions.

Since these expenses are not taxable, it’d help you reduce how much you pay on your profits.

Let's consider an example:

Say your company made £30,000 at the end of the year, and you spent £5,000 on allowable business expenses. You wouldn’t have to pay tax on the entire £30,000. Instead, you’ll only pay tax on £25,000 (because £5,000 was spent on allowable expenses).

For an expense to be considered allowable, it must be spent solely for the purpose of running your business and nothing else.

What are examples of expenses that fall into the allowable expenses category?

What you can claim as an allowable expense in the UK

Here are some common cost categories and items included in those categories you can claim as allowable expenses.

Office, property, and equipment: This covers costs such as office phone bills, stationery, fax, postage, software, printing, rent, and other small office tools and equipment.

Car, van, and travel expenses: Expenses like fueling, servicing, vehicle insurance, license fees, business travel visas, train tickets, and bus fares are covered in this category. You should note that daily commute to and from work does not fall under this category.

Clothing expenses: Clothing becomes an allowable expense if it is spent on a uniform, any protective clothing needed for work, or any clothing material required for work, for instance, a costume because you're an entertainer. Regular clothing worn for work does not count as an allowable expense.

Staff expenses: This includes expenses like employee salaries, bonuses, pensions, and employer’s National Insurance Contribution (NICs).

Reselling goods: Costs incurred to acquire raw materials, produce sellable goods, and transport materials.

Legal and financial costs: This covers bank charges, credit card charges, overdraft fees, interest on business loans, and the cost of hiring financial specialists or professionals like accountants, auditors, and solicitors.

Marketing, entertainment, and subscriptions: This includes expenses involved in subscribing to trade journals or magazines, advertising in printed media, and building a business website.

Training courses: Expenses on classes that help you improve your skills in your current business count as allowable expenses. These, however, do not include courses that train you to start a new business.

How to claim allowable expenses in the UK

You can claim allowable expenses by summing up all your costs and including them in your Self Assessment tax return.

Although you don’t need to submit proof of your expenses to HMRC to claim allowable expenses, it’s vital to keep an accurate record of expenses, just in case HMRC asks.

What are ‘disallowable' expenses?

Disallowable expenses are expenses that, although closely related to your business, cannot be claimed as corporation tax reductions here in the UK.

Since these expenses are business-related, it’s easy to mistake them for allowable expenses.

If you’re wondering what to categorize as a disallowable expense, ask yourself:

“Is this expense solely for the purpose of running my business, or does it benefit me in any way?”

Expenses with personal benefits or aspects are considered disallowable expenses — which are taxable. This also includes the benefits-in-kind that you offer employees or directors.

Disallowable expenses that can't be claimed as corporation tax

Here are some examples of disallowable expenses ineligible for a corporation tax deduction:

Business entertainment: This includes entertainment, gifts, and hospitality you offer to clients, customers, or suppliers.

Loan repayment: Personal loans (even if it’s to help run your business) and overdrafts count as disallowable expenses.

Clothing: Everyday clothing or attire is considered a disallowable expense.

Asset depreciation: Costs incurred to manage the depreciation of assets like cars and other work equipment are classed as disallowed expenses.

Fines and penalties: This includes all the costs you incur due to breaking the law. Examples include parking fines and VAT penalties.

Donations: Any donations you make to charities, clubs, or political parties, are considered disallowed expenses.

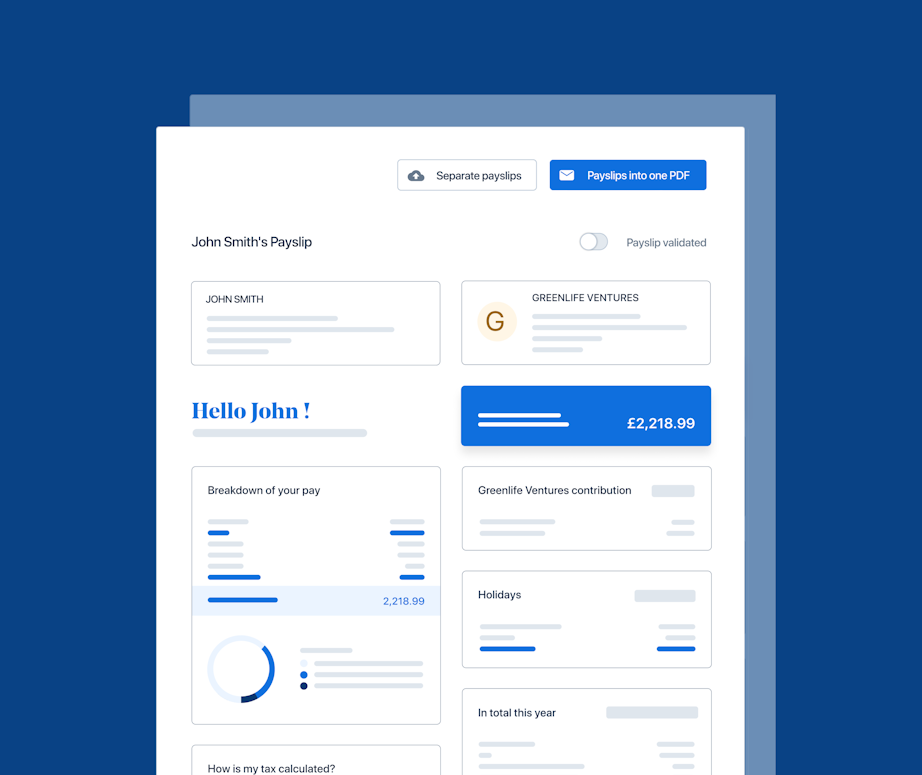

Handle all your expenses with PayFit

It is not enough to simply know the difference between allowable and disallowable expenses. You also need to find a way to handle or manage all these expenses.

Without proper management, you’ll soon find yourself overwhelmed with paperwork and dealing with employees unhappy about the inaccurate deductions on their wages.

To avoid all these potential issues, it’s crucial to use proper payroll software.

PayFit has an expense management feature that makes it easier for UK businesses to accurately track all allowable and disallowable expenses so you can focus on other essential parts of your business.