Five ways businesses can use data to reduce gender pay gaps

Gender pay gap reporting is the process by which organisations publicly disclose their gender pay gaps. This involves identifying and analysing the differences in pay between male and female employees within an organisation across all levels and roles. The gender pay gap is the difference between the average hourly earnings of men and women in a workforce, expressed as a percentage of men's earnings. The process of gender pay gap reporting is an essential tool for assessing and addressing gender inequality within organisations.

In this article, written by one of our partners, pihr, we will cover five ways that businesses can use data to reduce gender pay disparities.

The importance of assessing gender pay gaps within an organisation

Gender pay gaps can arise as a result of a range of factors, including differences in job roles, seniority, education, and experience. However, they can also be a result of bias, discrimination, and unequal opportunities, which can have serious implications for employee morale, retention, and productivity. Therefore, it is important that organisations assess their gender pay gaps to identify any inequalities and take steps to address them.

Information looked at as part of gender pay gap data

Gender pay gap data can provide valuable insights into how pay is distributed across an organisation, broken down by gender. Typically, gender pay gap data includes information on:

Mean and median hourly pay gaps between men and women

Proportions of men and women in different pay quartiles

Bonuses received by men and women

The proportion of men and women receiving bonuses

The five steps that can help in closing the gender pay gap

Closing the gender pay gap is a complex issue that is influenced by a range of factors. Addressing these issues requires a multifaceted approach that involves a sustained effort and long-term commitment. Here are some steps that we believe can help in closing the gender pay gap.

Conduct equal pay audits

The first step towards fixing gender pay gaps is to identify their root causes. By conducting a pay audit analysis, you can identify any potential pay disparities and take steps to address them. You can perform an equal pay audit on your own, but it can be quite time consuming, and the risk of error is high. It’s always recommended to use data driven tools that have been designed to make the process as easy as possible.

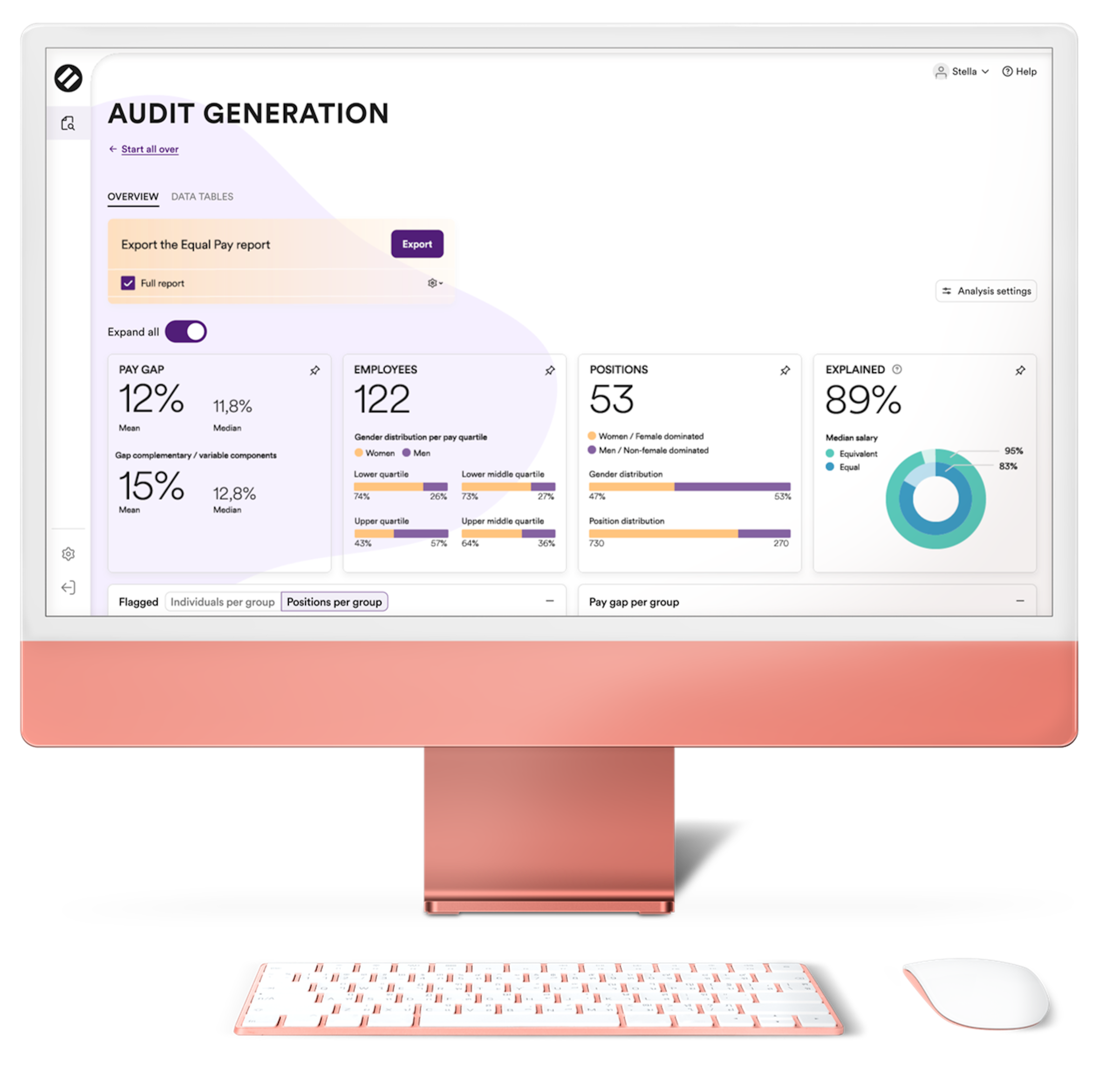

Pihr pay equality is one such software that can support organisations in gathering and analysing gender pay gap data by automating the process of data collection and analysis. This can help HR teams access gender pay gap data quickly and easily and generate reports, enabling them to identify any areas of inequality and address them. The use of Pihr’s software can also help to reduce errors and ensure that gender pay gap data is accurate and consistent across the organisation.

Pihr’s software helps you conduct pay audit analyses in seconds, not months.

Let’s look at how it works.

Step 1. Job evaluation of positions

Use your current job evaluation scheme or let our software help you identify similar and equivalent positions.

Step 2. Import data

Easily upload data from your payroll system - for example PayFit - to our platform.

Step 3. Identify pay inequities

Instantly identify unjust salary disparities and get recommendations on how to close the gaps.

Step 4. Get a compliance report

In a matter of seconds, you’ll get a written report that meets the legal requirements for pay equity and gender pay gap reporting.

Make a move towards pay transparency

CFOs can work with HR and other stakeholders to implement transparent pay policies and practices that clearly outline how pay is determined and how that applies to individual employees, as well as whether pay is equitable or not.

You can encourage transparency by making pay data available to all employees. When employees understand the company pay structure, pay ranges and how their performance and experience factor into their pay, they are more likely to feel that they are being treated fairly.

This can build trust with employees and reduce the impact of unconscious bias and pay disparities in the workplace.

Invest in female leadership potential

Use data to track diversity metrics, such as the percentage of female employees at different levels of the organisation, the gender breakdown of new hires and promotions, and representation of women in leadership positions. By tracking these metrics, you can identify the areas where you need to focus efforts to address the gender pay gap.

Set long-term goals and action plans and share results along the way

The CFO can work with the executive team to set pay equity goals and develop an action plan to achieve them. The goals need to be clear, measurable and data-driven with a clear timeline to determine what will be delivered and when. It is important that you communicate and inform employees, managers, board members and other stakeholders about the process and the results. Sharing the results is an essential part of creating a culture of equity and inclusion in the workplace and it promotes transparency and accountability.

Pihr’s software provides you with visual graphs, easy-to-understand dashboards, plus interactive charts that can be incredibly helpful in presentations and communications with your teams. This can be a powerful tool to improve clarity when presenting complex data and make it easier for your audience to understand it.

Monitor and measure pay equity regularly

Monitoring and measuring pay equity regularly is a crucial step for organisations to ensure that they are making progress in closing the gender pay gap over time. Collecting and analysing pay data can help identify any issues before they become major problems. We recommend running pay audit analyses on a monthly or quarterly basis and not just once a year. Pihr’s software provides real-time insights and actionable data that can help you identify areas where further action may be needed, and to ensure that your efforts are having an impact.

How data can help finance to close gender pay gaps

Data helps finance teams to create a more accurate picture of the organisation's financial performance, highlighting any areas where resources are being allocated ineffectively. This can also help finance teams to identify any potential risks or opportunities associated with the organisation's pay structure, enabling them to make data-driven and informed decisions and recommendations to senior management.

Conclusion

There are many reasons, besides the legal requirements, as to why an organisation should report and work to reduce its gender pay gaps. By ensuring that men and women are treated equally an employer can improve its reputation and its ability to attract and retain top talent.

At an organisational level, the benefits from closing the gender pay gap translate into higher business earnings and improved growth. Research from around the globe all points to the same conclusion: gender diversity at all levels of an organisation leads to higher shareholder returns and a more engaged workforce.

Finally, data and technology can play a critical role in achieving pay equity in the workplace by providing the information and tools needed to identify and address gaps within the organisation.

You can book a demo or register for our upcoming webinar here to find out how pihr can help you achieve pay equity and close the gender pay gap within your business.