Apprenticeship incentive payments

Incentive payments for hiring new apprentices have increased. Under the new rules, employers will receive £3,000 for apprentices of all ages who join their organisation between the start of April 2021 and 31 January 2022

This new payment will be in addition to the £1,000 employers receive for apprentices who are:

aged 16-18;

below 25 with an education, health and care plan;

who have been cared for by their local authority.

What if an apprentice joined before 12 April?

Employers will receive £2,000 for apprentices aged between 16-24 who joined an organisation between 1 August 2020 and 31 March 2021. For Apprentices 25 and over, employers will be entitled to £1,500.

The deadline for applying for these apprentices is 31 May 2021.

Apprenticeships from 1 April 2021

Organisations that recruit apprentices between 1 April and 31 January 2022 will be entitled to receive £3,000.

The application for these incentive payments can be made from 1 June until 31 January 2022.

What can the payment be used towards?

Unlike apprenticeship levy funds, the payment can be used on anything to support a company’s costs. It also doesn’t have to be paid back.

Who’s eligible?

Applications can be made for all apprentices who joined an organisation between 1 August 2020 and 31 January 2022 are eligible.

What about the application process?

The application for incentive payments can begin once an apprentice has been added to an organisation’s apprenticeship service account.

When will the money be received?

The process can take up to three months and no payments can be made until HMRC has received and subsequently verified an organisation and its financial details.

Payments are made in two equal instalments for each apprentice. The first instalment will be paid after an apprentice finishes the first 90 days of their apprenticeship and the second after 365 days.

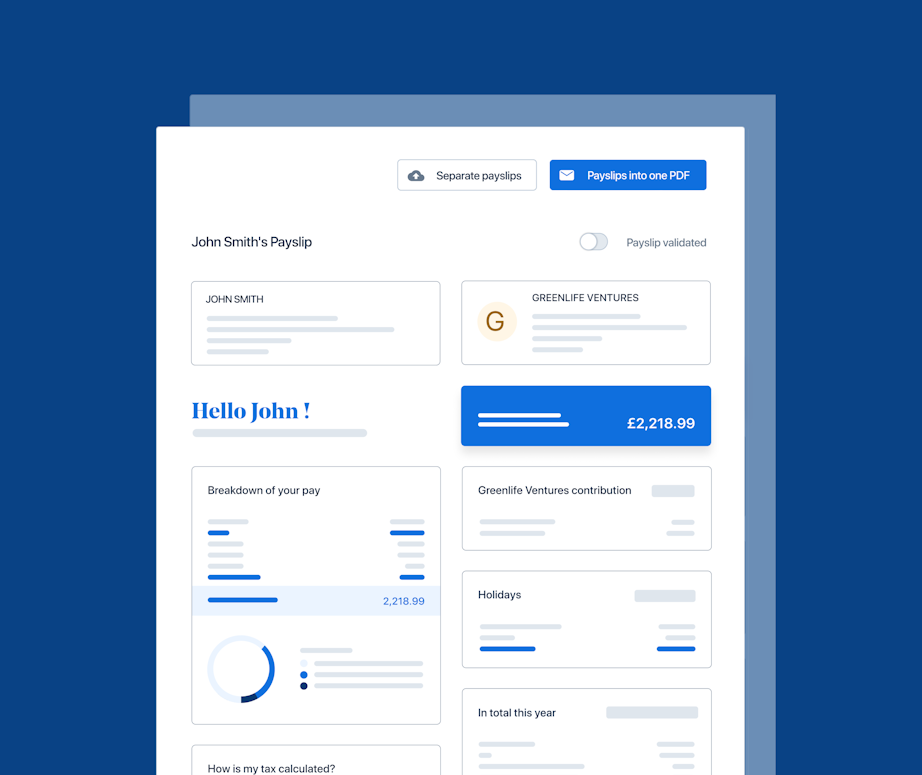

The PayFit app & apprenticeships

A company can add apprentices to their employees on the PayFit app.

Minimum wage rates for apprentices are automatically set up in the app and administrators receive a required action notification should any apprentices receive below the legal minimum.

Keen to find out more? Book a demo with one of our product specialists today.

PayFit disclaimer

The information contained in this document is purely informative. It is not a substitute for legal advice from a legal professional.

PayFit does not guarantee the accuracy or completeness of this information and therefore cannot be held liable for any damages arising from your reading or use of this information. Remember to check the date of the last update.

P11D Forms Explained: A Guide For UK Employers In 2025

How Much Does an Employee Cost UK Employers in 2025?

Bank Holidays UK: Employment Law Guide 2025

UK Statutory Notice Periods - An Explainer For Businesses

What Is OTE? How UK Businesses Can Unlock Its Potential