Gross vs Net Payroll: What’s the Difference?

As soon as you make your first hire, you’re plunged into the payroll world. Before you know it, you’re deciphering jargon like gross vs net payroll and trying to understand how it’s all calculated.

In this blog, we’ll explore what gross vs net wages are and the difference between gross salary and net salary. We’ll also cover some best practices to ensure your payroll is managed as efficiently as possible.

What is gross pay?

Let’s start by defining gross pay. This is the salary an employee receives before any deductions are made, like income tax, national insurance, auto-enrolment pension contributions, etc. Gross pay includes your basic salary plus any bonuses or overtime worked in the period.

How to calculate gross pay

Calculating gross pay is pretty straightforward, as you're not accounting for any deductions. Simply divide your annual salary by the frequency you get paid.

For example:

£50,000 annual salary, paid monthly, Is £50,000 divided by 12, which is £4,166 gross pay per month.

Remember, the employee won't get this amount; tax and other deductions will be made before the final amount is paid into their bank account.

If your employee isn’t salaried but instead works hourly. To calculate gross pay, you would multiply the number of hours worked in a given period by the hourly rate.

For example:

You pay hourly workers £11.44/hour, and they work a total of 148 hours in 4 weeks (averaging 37 hours a week). £11.44 multiplied by 148 means their monthly gross pay is £1,693.

What is net pay on a pay slip?

Let’s move on to what we mean by net pay. Net pay is the salary you're left with after all deductions. This is the money you'll deposit into the employee’s bank account.

How to calculate net pay

To calculate net pay, you first need to understand the gross pay. Once you know that, you can start deducting relevant taxes and contributions the employee needs to pay.

For example:

Let’s say your gross income (income before tax) is £30,000; after your tax-free personal allowance, which is currently £12,570, 20% income tax is deducted (£3,486) and National Insurance (£1,394). This makes your take-home pay £25,119 annually and £2,093 monthly.

It’s not just income tax and National Insurance that can be deducted from your gross pay. Pay deductions can also include:

Pension contributions

Work scheme contributions like gym memberships, etc.

Student loan repayments

Why employers need to know the difference between gross vs net payroll

It's simple: without understanding what the difference is between gross and net pay, you can't accurately manage your finances. You can't forecast cash flow, you can't adequately budget for tax increases, and sometimes, you might be unable to pay staff.

Aside from the direct benefits to the employer, employees also need to understand the two figures and what they mean to see where their money goes and feel more informed about any tax implications should they want to start a side hustle. So, by giving them a breakdown of gross versus net salary, you’re empowering them as an employer.

Three best practices for managing payroll more efficiently

Looking for some tips and tricks to streamline your payroll processes better? Here are three!

1. Automate as many payroll processes as possible

Automation frees up payroll administrators, allowing them to focus on forecasting, salary benchmarking and other important business tasks (it also significantly reduces manual errors and clumsy mistakes). Automate things like net payroll calculations and payslip generation and distribution to rid your team of the admin burden.

Psst. From RTI submissions to holiday pay calculations, you can automate up to 90% of manual payroll tasks with PayFit.

2. Ensure you keep accurate records

Maintaining accurate payroll records means anyone accessing the data to drive business decisions is accessing correct data. Keeping inaccurate records can lead to pay discrepancies and incorrect tax information.

If you implement a digital payroll solution, your records will always be accurate across your tech stack, from accounting software to pension providers — your data syncs automatically.

3. Stay compliant with UK tax regulations

Remaining compliant means fewer headaches for your payroll team and your organisation overall. If you aren’t compliant, you face hefty fines and penalties, leading to cash flow problems, increased scrutiny from HMRC and even reputational damage.

Guess what? Using payroll software like PayFit means you’re always UK tax regulation compliant. Our software is always updated with the latest tax codes and regulatory changes, so that’s one worry off your mind.

Gross vs net wages FAQs

Are UK salaries gross or net?

When employees first accept a job offer, the salary agreed upon will be a gross pay number, meaning they won't receive the full £30,000 salary over the course of 12 months. Deductions will be made from this.

What is the biggest difference between my gross pay and net pay?

The difference between gross and net pay is net pay is your ‘take-home pay’, the money you will actually receive from your employer every payment run. Gross pay is the money you've earned before tax and other deductions.

What is a good net salary in the UK?

According to research, the average full-time employee salary in the UK is £34,963, which means the average net is just below this figure when all deductions are taken into account. A good net salary for an individual will depend on the cost of living and other expenses.

Do you pay tax on net or gross salary UK?

The net income is the money you receive after paying tax, so you pay tax on your gross income.

How PayFit helps you manage gross and net salary

Not only does our smart payroll software automatically calculate net pay on your behalf, it keeps you compliant with UK tax regulations, so you always have a clear picture of your finances, helping you plan for future growth.

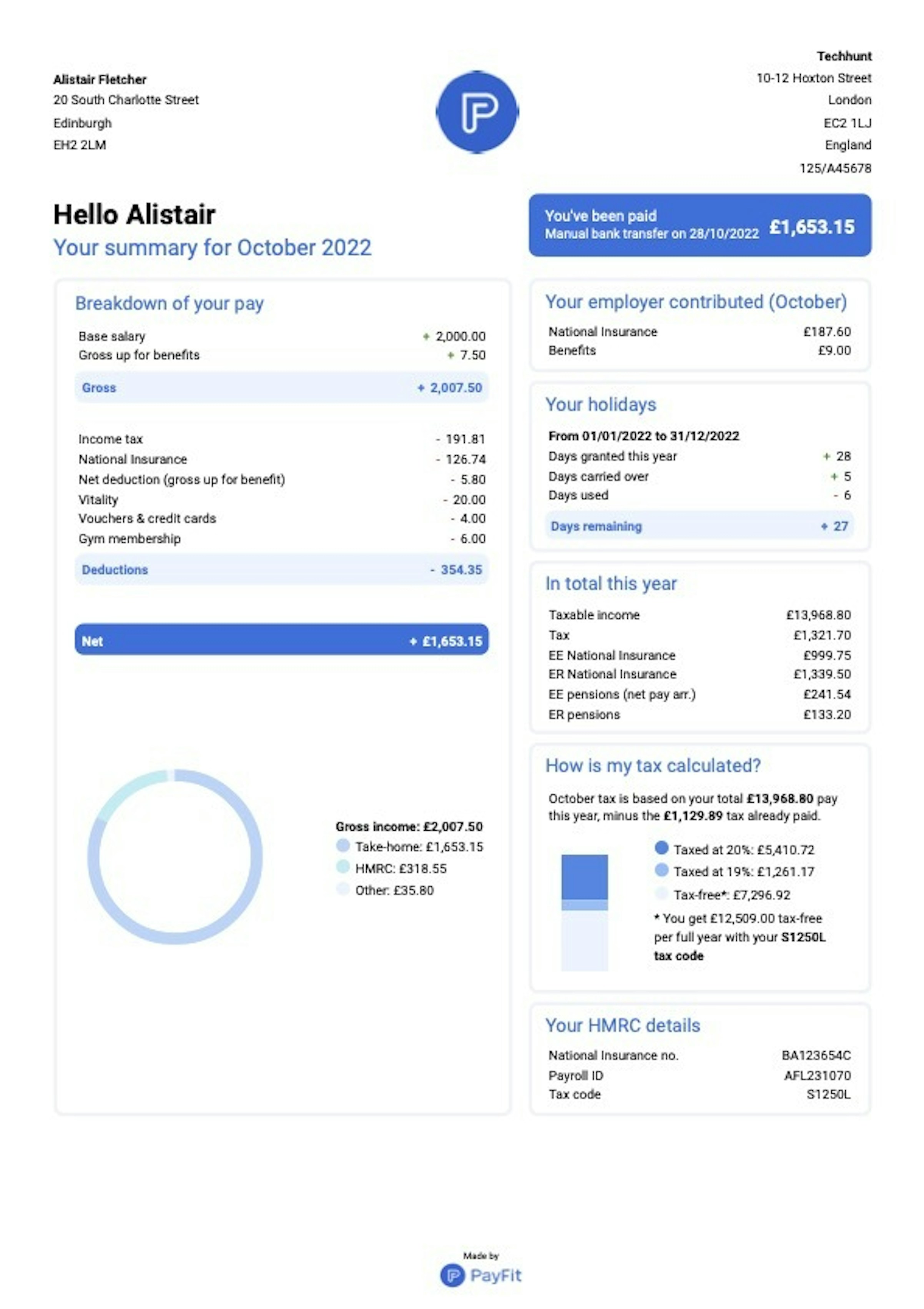

Our digital payslip management gives employees their own portal to access payslip explanations and breakdowns like this one:

The simplistic layout and clear explanations empower employees to understand more about what tax goes where, how much they contribute to their pension, and access additional details like remaining and taken annual leave allowance, tax code and more.

Allowing employees to self-serve helps keep the pay process transparent and devoid of confusion. This ultimately helps HR and finance teams avoid frequent employee emails asking questions about their payslips or removes the need to manually process anything to do with payroll ever again. We'd call that a win!