Embrace the new era of payroll for less

Start the new tax year off right with our best offer yet. The sooner you sign up, the bigger the savings.

.jpg?)

9,500+ companies have already made the leap

New tax year, same payroll problems?

Outdated systems hold you back. PayFit sets you free. To kick off the tax year with a fresh solution, we’re helping you save even more.

New tax year countdown savings

3 months free

When you sign up in January

2 months free

When you sign up in February

1 month free

When you sign up in March

Beautifully designed

Cloud-based payroll software never looked this good. Payslips update in real-time so you can run payroll in minutes.

Expertly supported

We’re HMRC-approved and backed by real, behind-the-scenes payroll experts on hand to answer your queries.

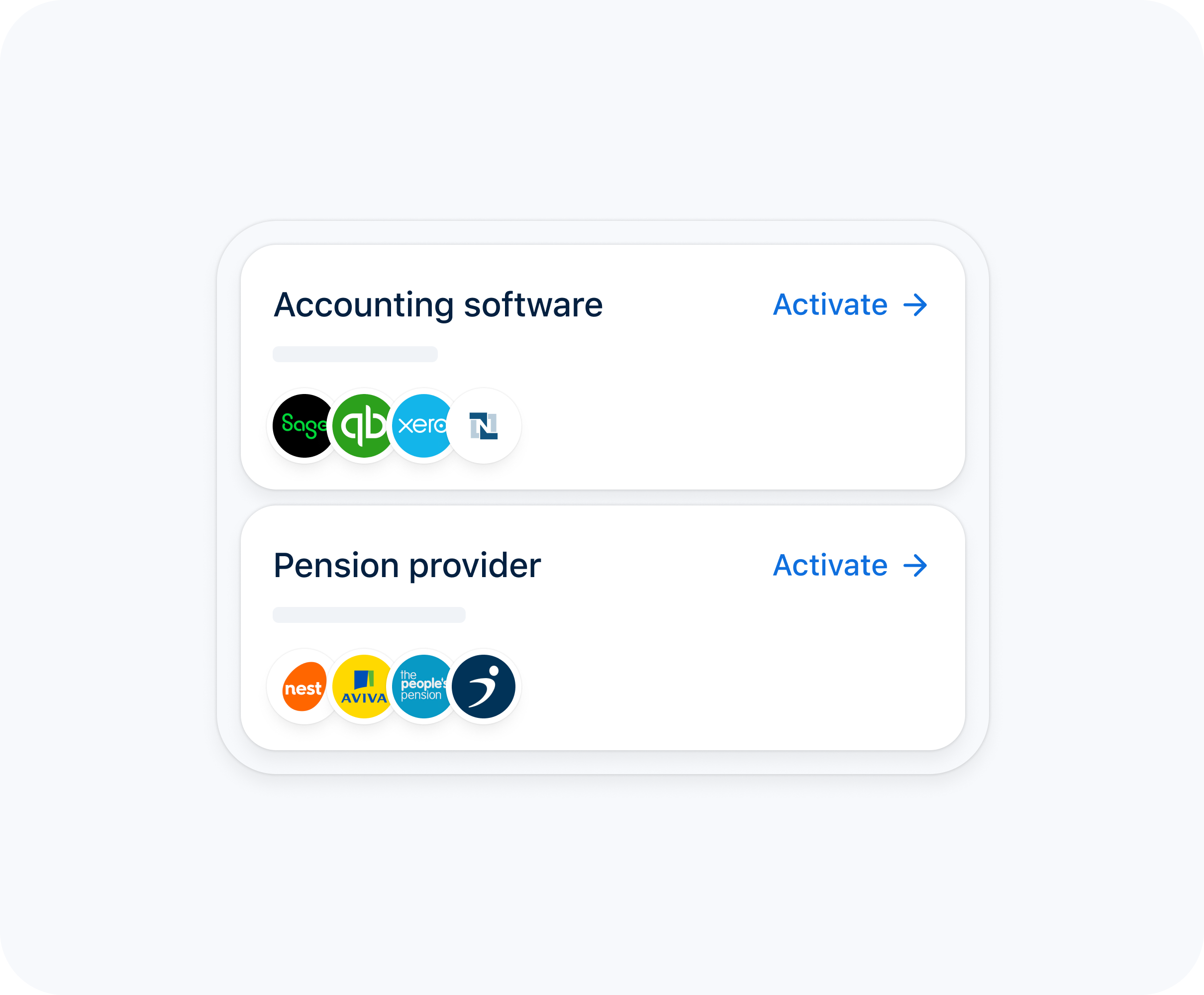

Powerfully integrated

We fit right in with the best, whether it’s syncing with top accounting tools or integrating with market-leading HRIS.

The numbers are in

What could PayFit do for my business?

So much more than ‘just’ payroll software

Track leaves and expenses. Run custom reports. Integrate PayFit with other solutions like HRIS to make your dream tech stack a reality.

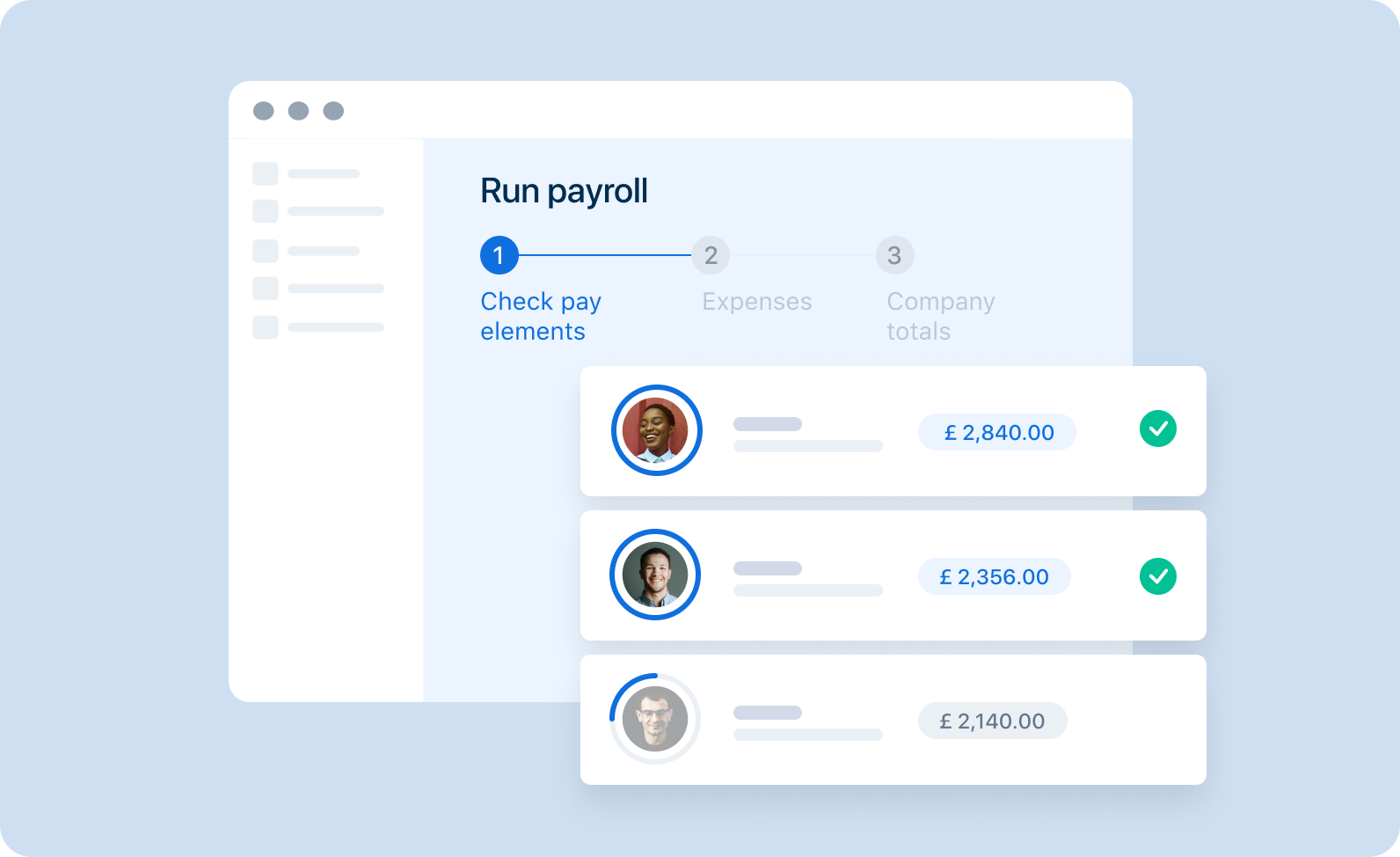

New Run My Payroll workflow

Complete your payroll for the month in 6 easy-to-follow steps. Our new Run My Payroll workflow makes it easy for anyone on your team to review monthly changes before checking payslips and running payroll in just a few clicks.

Power to your people

PayFit makes it easy to empower your employees. Lifetime access to their own secure portal means any employee can download their payslip, P60s, P45 or P11Ds anytime. Employees can also enter expenses and request leave, making your job easier.

.jpg?)

Discover PayFit today

Book a 10-minute discovery call to find out if PayFit is right for you. If you decide PayFit is right for your team over the next 3 months, you’ll be eligible for our new tax year countdown savings.

No lengthy contract

Cancel any time. Monthly subscription with no cancellation fees.

No hidden fees

We don't charge any additional fees to generate documents and year-end forms.

Secure and compliant

A secure and compliant cloud-based solution: HMRC-approved and ISO27001 certified

Frequently Asked Questions

-

How does PayFit compare to an outsourced payroll solution? Will I get personalised support from payroll experts?

PayFit combines the best of both worlds! You'll get the benefits of using a fully automated, cloud-based payroll software that allows you to easily and quickly run payroll in-house with dedicated support from our payroll experts.

-

Does PayFit handle submissions to HMRC, pensions auto enrolment and company benefits?

Yes! PayFit is HMRC certified and will handle all RTI submissions on your behalf. We also accommodate to a very wide range of company benefits, you don't need to worry about any tax implication, everything is automatically calculated in the app and PayFit will take care of generating P11Ds as well as payrolling benefits.

-

Does PayFit integrate with other software?

Yes, you can sync your HR data from HR Software Hibob, BambooHR and Personio. PayFit's payroll journals are also compatible with accounting software Xero, Sage, Quickbooks and Netsuite, so you can import them in a click!

Hear why our customers love using PayFit

"PayFit has helped us reduce the time spent on payroll by 60%. We are able to complete all payroll duties in less than two days, with more flexibility."

"PayFit's fantastic customer service is always available and responsive. It's great because you feel like you're talking to a payroll expert every time."

"PayFit works well for startups because the automation means that you don’t need teams of people to manage a hugely bulky administrative process."