Your end-of-tax-year compliance checklist

- A clear and easy to follow list of key EOTY tasks needed to close 2024/25 (and prepare for 25/26)

- Brush up on all new legislation changes for the year ahead

- Get additional tips for remaining compliant

Whether it’s your first year-end or your fortieth, our checklist will save you time and hassle

Tax year-end can be a busy, potentially stressful time, with lots of different documents to be submitted and payments to be made, lest you wind up on the wrong side of HMRC. It’s important not only to get year-end right, but to ensure that you keep both yours and your team’s stress levels to a minimum. Our checklist will help you do just that.

Download our checklist to discover:

The key actions required to close 2025 compliantly

All the latest legislation changes for the year ahead

How PayFit helps slash the time spent on year-end

The PayFit difference

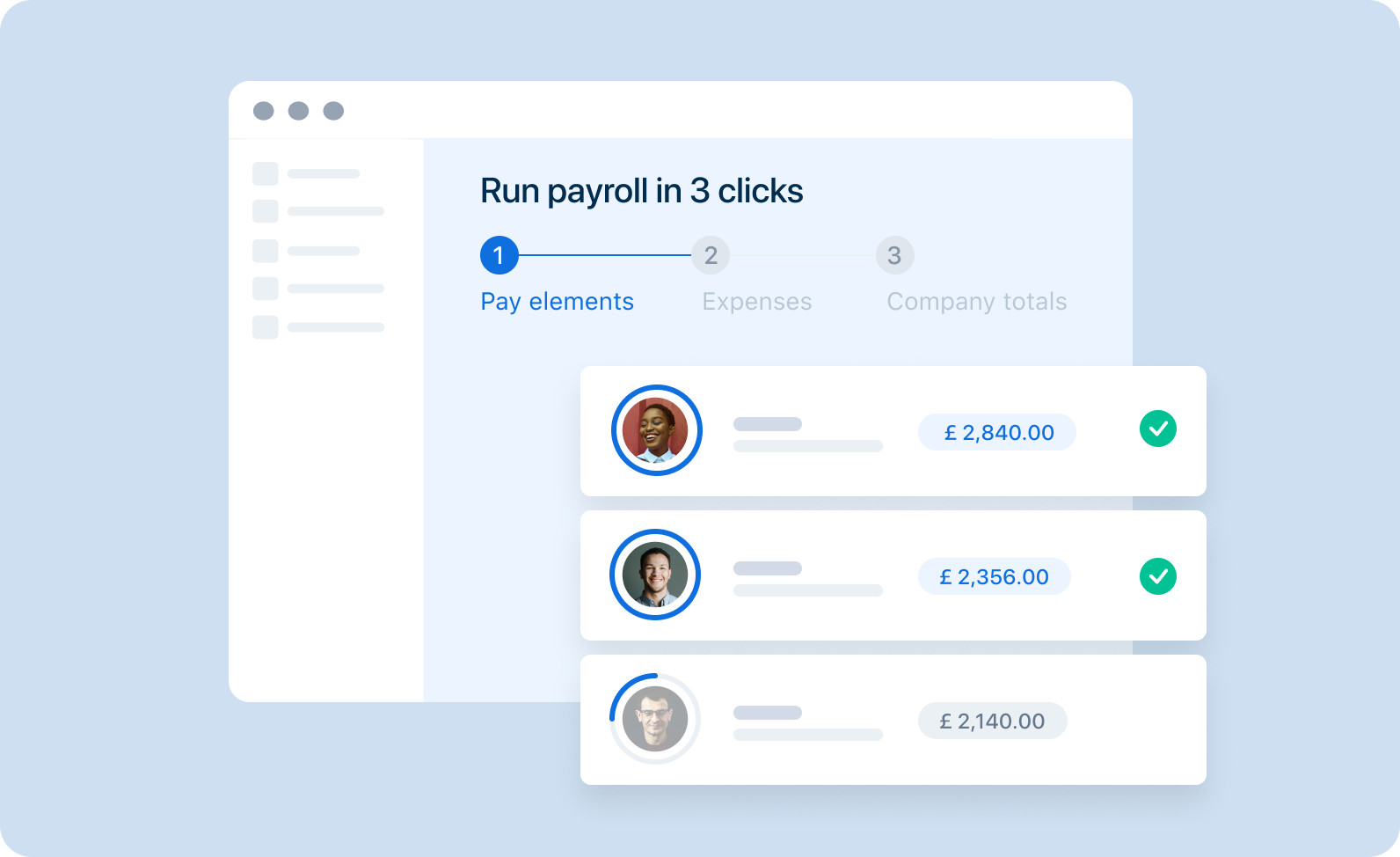

No more manual year-end calculations

-

Our unique programming language ensures all new legislation is applied automatically for each tax year - no need to call your payroll provider or tinker with changing rates.

Integrate with your existing HR software

-

Integrations with the likes of HiBob, BambooHR and Personio means no more double data entry, at tax-year end and always.

Slash the amount of time taken up by payroll

-

PayFit has been proven to reduce the time previously spent on payroll by up to 80% each month, freeing up your resources and headspace for strategic, game changing work.